Cashback up to VND 3 million/ month

Up to 10% cashback in the Restaurant sector and 3% cashback in the Travel & Hotel sector, up to 3 million/ month

Maximum cashback is VND 3 million/month for each credit card account. Manage each transaction in detail and withdraw cashback easily in Techcombank Rewards.

Techcombank Visa Signature credit card has the lowest foreign currency transaction fee among card lines and is very competitive compared to the market (average about 1 - 3%/transaction amount).

Techcombank Visa Signature credit card has a standard annual fee of VND 1.499.000/year

Membership privileges

Customers who are Private or Priority members of Techcombank will be exempted from the annual fee.

Offer for Non-member

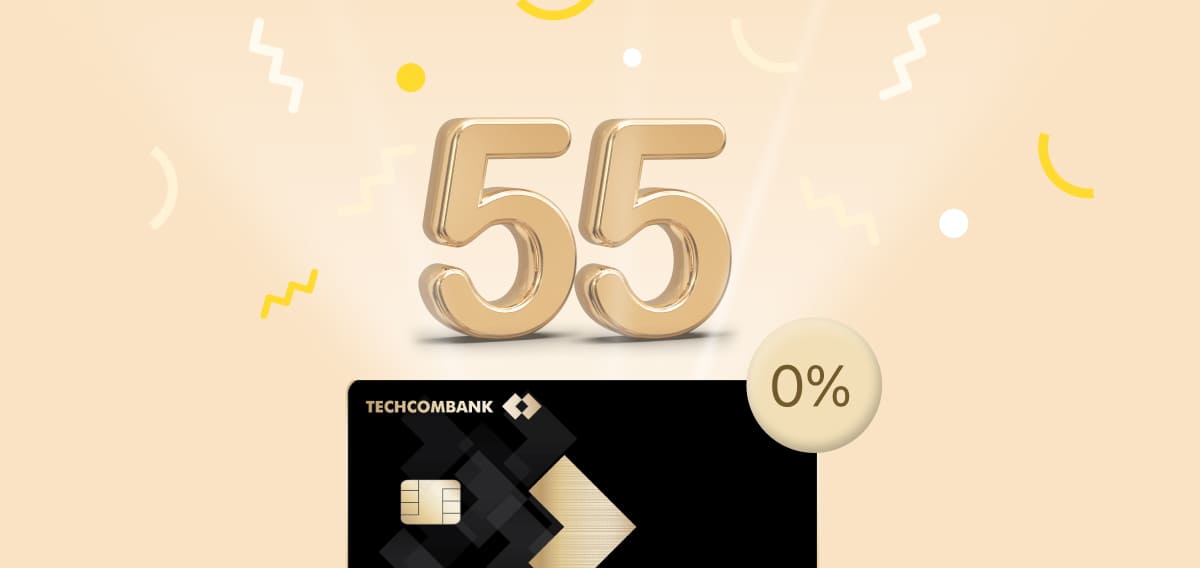

Techcombank Visa Signature credit cardholders enjoy up to 55 days of interest-free period. This is the longest interest-free period on the market today. Specifically, after 1 credit cycle (30 days), customers will have up to 25 more days of interest-free period. This helps customers be more proactive about time and money sources, ensuring timely payment to the bank.

*Interest-free period does not apply to cash withdrawals and late payments.

The cardholder and his/her relatives, including spouses and children, will enjoy global insurance worth up to 11.7 billion VND in case of any problems during the trip such as personal accidents, terrorism, etc. This helps ensure the rights of the cardholder and relatives when traveling or working abroad.

Accumulate spending, cashback continuously up to 700,000 U-points

Discounts of up to 700,000 VND when shopping at Dien May Cho Lon supermarket system

Swipe card, receive cashback up to 1,5 million U-points

Up to 50% cashback on transactions in the Insurance, Travel, and Education category

Up to 50% cashback for customers making their first and second installment payments

Enter code TCBJX for unlimited 5% discount when booking air tickets at Starlux Airlines

Discount up to 300,000 VND when making payment with Techcombank Cards at Aeon Malls.

Reward up to 700K when paying through Shopee partners.

Up to VND 1M off golf services with Visa Infinite & Signature

Discount 13k when spending by Techcombank Visa card at Starbucks

Free Hanoi Metro Trip Program with Techcombank Visa Card

0% interest 0% fee for installment payment at Dien may Cho Lon

Up to 10% discount on Tam Son Premium and Luxury brands

Enjoy Visa card privileges up to 50% at luxury restaurants

Enjoy up to 2 million VND cashback when you apply

for a Techcombank credit card and start spending today

Tap the Contactless card to pay quickly and conveniently

Apply the world's leading security technology to verify online transactions

Pro-actively lock/ unlock, manage credit limits and other online convenient features

Techcombank always accompanies and is ready to meet all your needs throught exclusive priority banking service

*Maximum 3,000,000 cashback points points per month

FEES

Priority customer | Techcombank Inspire | Regular customer | |

|---|---|---|---|

ISSUANCE FEE (based on new credit agreement) | Free | Free | Free |

ANNUAL FEE (annually, based on the validity period of card) | Free | 1,499,000 VND/card | 1,499,000 VND/card |

FOREIGN TRANSACTION FEE

| 1.1% of transaction amount | 1.1% of transaction amount | 1.1% of transaction amount |

SWITCHING COST FOR INSTALMENT TRANSACTIONS VIA CREDIT CARD (collected from cardholders who registered to switch from normal payment transaction into instalment transaction) | 0.6%/ month * transaction value * instalment period (Instalment period from 1 month to maximum of 12 months) | ||

See all fee schedules → | |||