Efficient profitability

Target profit 12%/year (*)

Attractive investment, comfortable life

Target profit 12%/year (*)

Top financial experts will pick the best stocks for you

Daily withdrawals are guaranteed. Convenient online transactions on digital platforms.

Diversified portfolio with listed bonds of leading companies.

(*) Based on the estimated yield rate of the bond and current promotion. This yield rate may be changed and not be indicated of future performance.

1

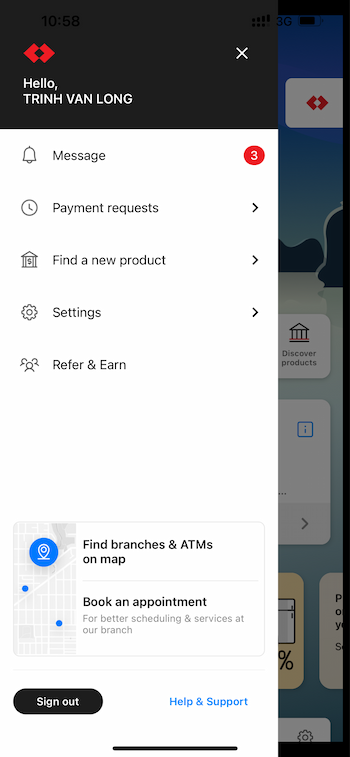

Login Techcombank Mobile app, then access to “Product Exploration” on menu bar

2

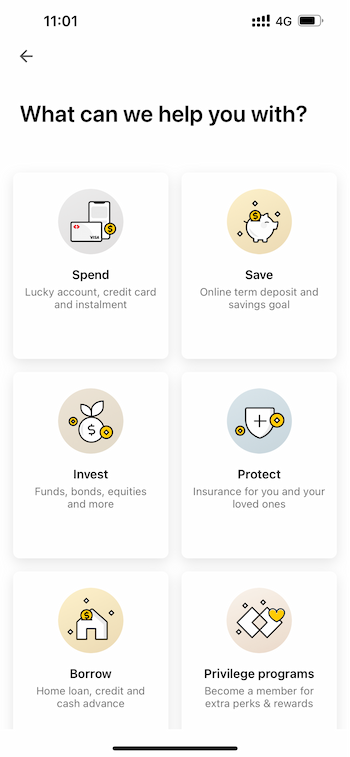

Select "Investment" item

3

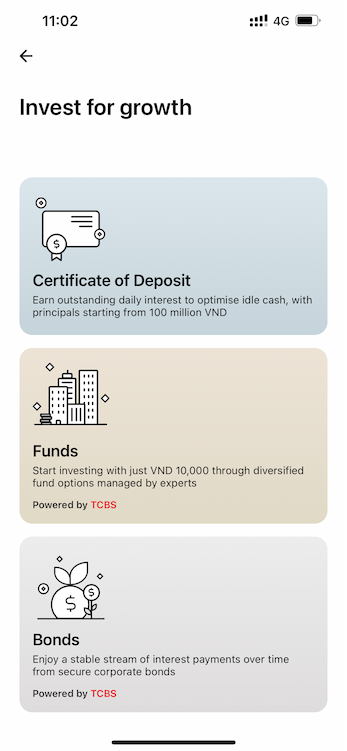

Select "Fund" in "Investment" item

4

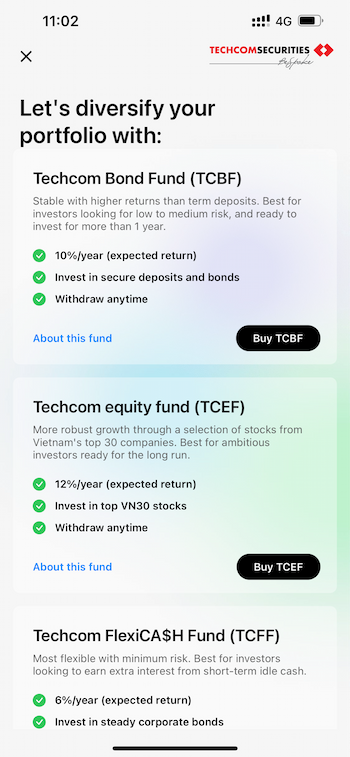

You can select TCBF or TCEF

With the goal of effective long-term profitability, TCEF does not invest in "hot-stock" with short-term speculation, we invest in stocks of the top 30 leading enterprises on the Vietnam stock exchange:

- Have good management capacity

- High long-term growth potential

- Leading market share

- Stable and strong finance ability

- Diversified and sustainable shareholder structure

Strictly adhere to the investment principles:

- List of no less than 15 stocks

- Do not invest more than 20% in 1 stock

- Total value of large investments does not exceed 40%

The detailed investment portfolio and proportions of the Fund are published in the Report "[TCBS] TCBF, FlexiCA$H and TCEF" sent weekly via email to customers who own securities accounts at Techcom Securities.

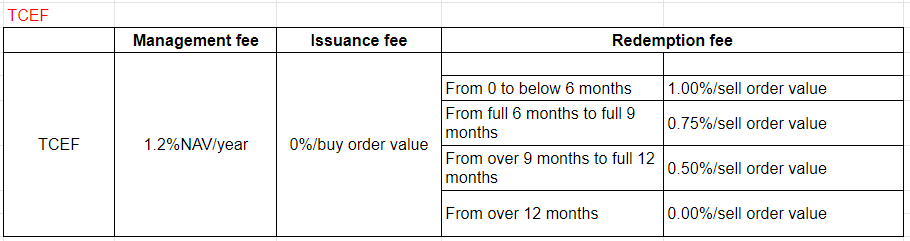

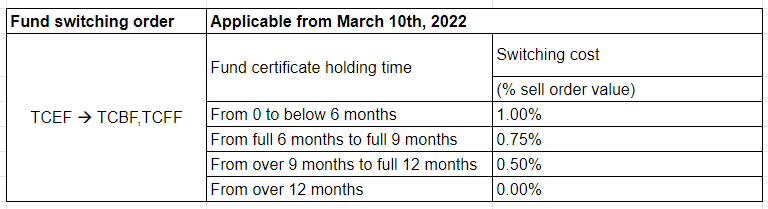

The lowest transaction fee in the market

Mr. Nguyen Xuan Minh, CFA

- Chairman of the Board of Directors of Techcom Securities (TCBS)

- Director & Co-Founder of Vietnam Asset Management (VAM)

- Senior Vice President of Franklin Templeton Investments

- 20 years of experience in the field of investment and fund management

Mr. Dang The Duc

- CEO of Indochine Counsel Law Firm;

- More than 18 years of experience in business law in Vietnam

- Experienced in consulting for some big foreign and local investment funds

Ms. Nguyen Thi Vinh Ha, CFA, CPA, FCCA

- Vice General Director of Grant Thornton Co., Ltd

- 18 years of experience in the field of accounting and auditing

- Got ACCA Certificate of Association of Chartered Certified Accountants and CFA Certificate since 2012

Some basic knowledge/ Questions about TCEF

Fund fee for repurchase of fund certificates and personal income tax

T+5

10,000 VND

Unlike public closed fund certificates, open-end fund certificates are not listed. When there is a need for transactions, customers can transact at the fund's designated distribution agents.

Fund Certificates do not determine maturity

Fund Certificate Issuance Fee (Fee to buy Certificate) and Money Transfer Fee (if any)

Yes, at least 10 (ten) Fund Units

It means the net asset value of the Fund, determined by the total market value of assets and investments owned by the Fund minus the Fund's liabilities as of the most recent day before the Valuation Date

The date a customer can buy, sell, convert the Fund or transfer Fund Units. Currently, trading date is all working days of the week (excluding Saturday)

Just be an Investor who owns Fund Certificates

10 (ten) Fund Units, except where the Sell Order requires reducing the number of Fund Units held to 0 (zero)

Standard Chartered Bank Vietnam Limited

No minimum balance is required

T+3 (excluding Saturday, Sunday, and public holidays)

As an open-ended fund that invests in bonds and valuable papers with the investment proportion in these assets accounting for a maximum of eighty percent (80%) of the net asset value

It is the last time the distributor receives orders to buy and sell Fund Certificates from customers

Before closing the order number

T-day

14h45 on T-1

FlexiCA$H Fund's investment strategy and portfolio differ from TCBF and TCEF. FlexiCA$H Fund invests mainly in government bonds, bank bonds, and certificates of deposit with high liquidity and flexibility. Therefore, FlexiCA$H Fund's customers are short-term investors under 03 months with an expected return rate of 6%/year.

FlexiCA$H Fund is an abbreviation of Techcom Flexible Bond Investment Fund, an open-ended fund managed by Techcom Fund Management Company