Active and flexible

Can withdraw a part of the principal before maturity without having to settle the entire deposit

Unlimited number of withdrawals

Actively, flexibly withdraw money in installments and keep the same level

interest rate applied to the remaining principal held until maturity

Can withdraw a part of the principal before maturity without having to settle the entire deposit

Unlimited number of withdrawals

The principal portion maintained to the Maturity Date: Retained and applied at the interest rate determined at the time of opening a new deposit.

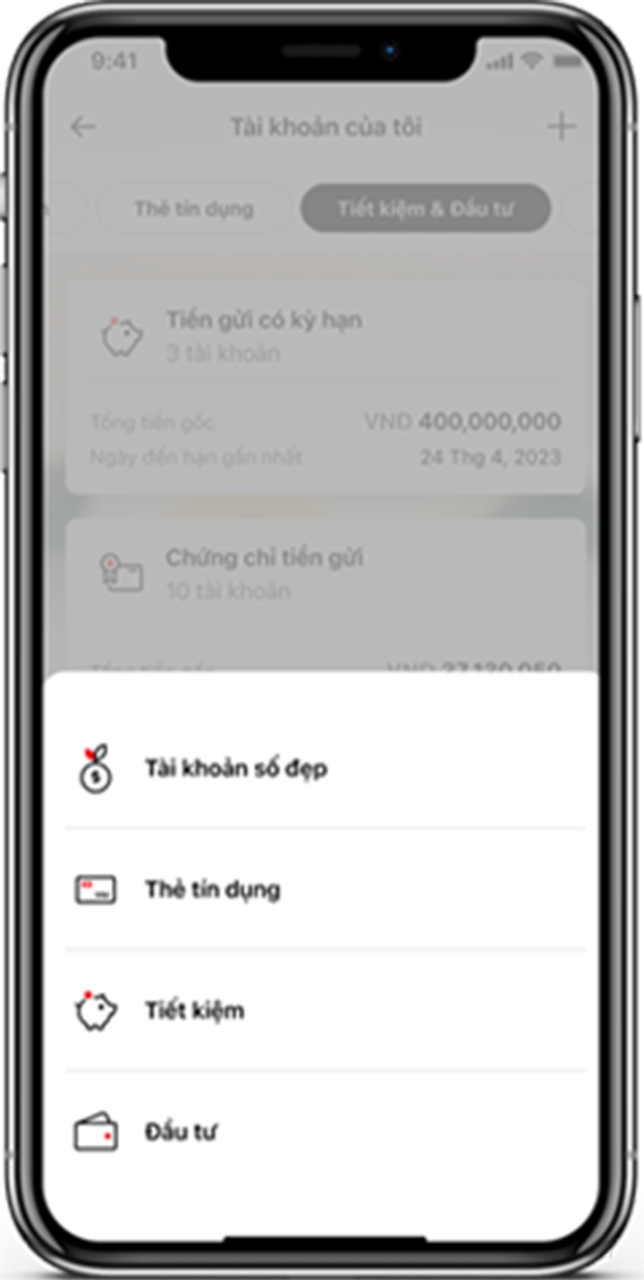

Actively transact anytime, anywhere on Techcombank Mobile or deposit/withdraw money easily at all Techcombank transaction points

TRANSACTION CHANNEL | At the counter | Techcombank Mobile |

CURRENCY | VND | |

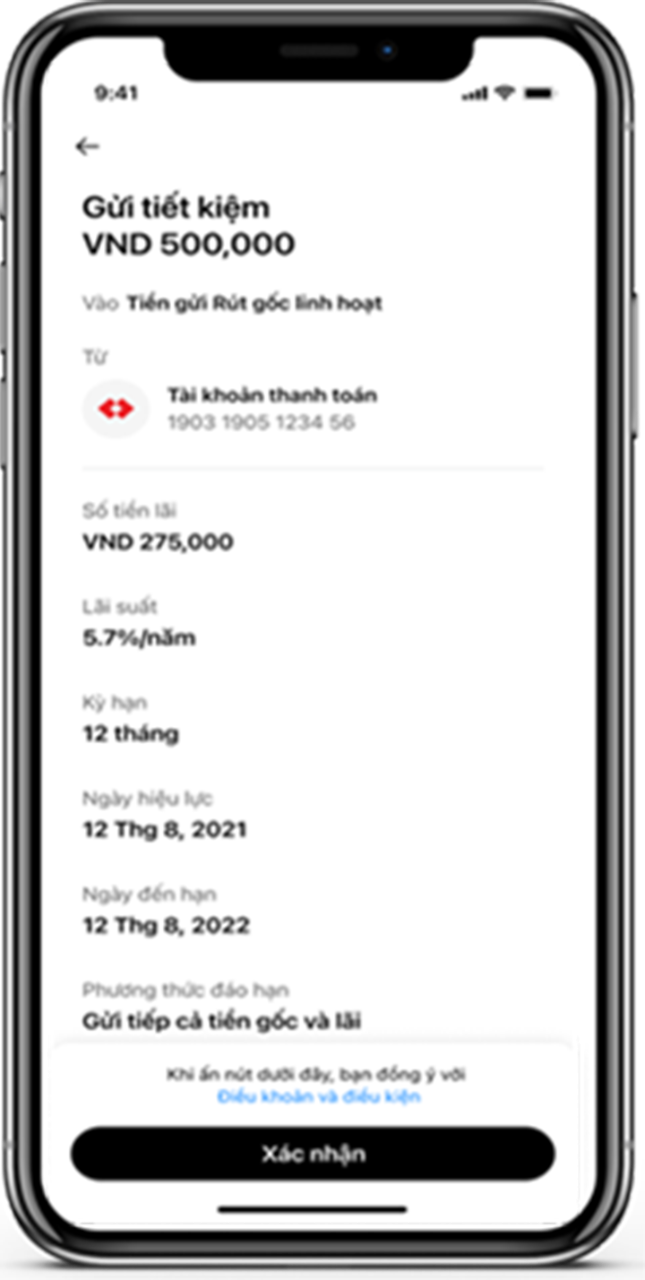

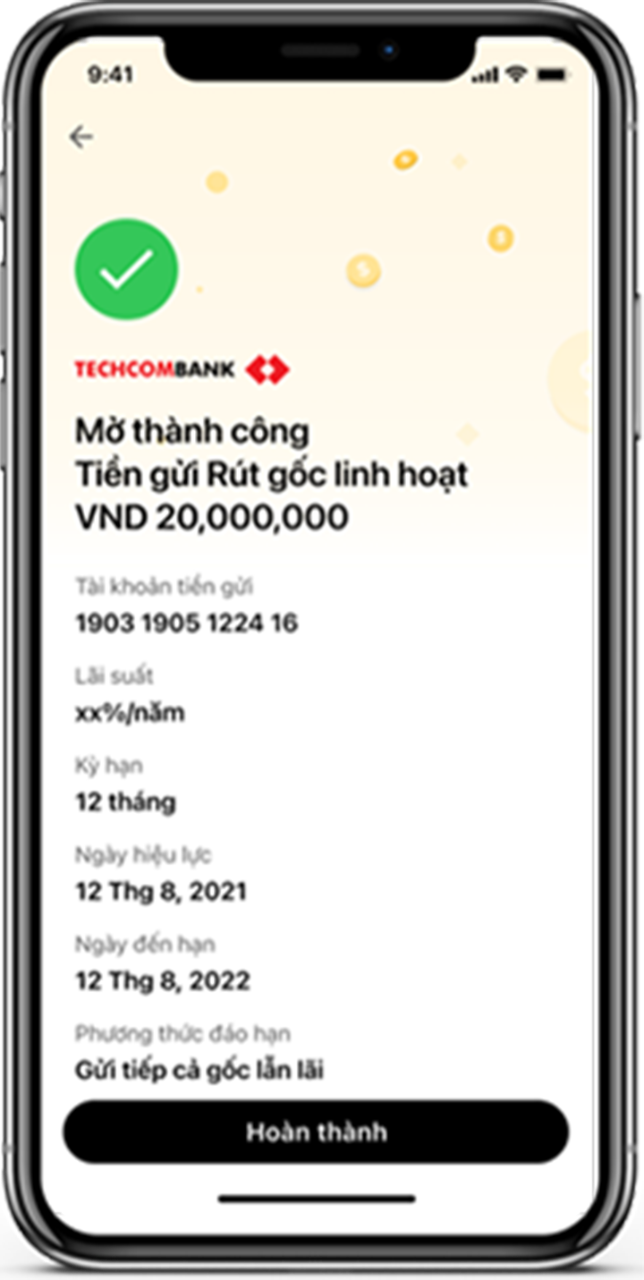

TERM | 1-12 months, 15 months, 18 months, 24 months and 36 months | |

MINIMUM DEPOSIT AMOUNT

| 20,000,000 VND | 5,000,000 VND |

MINIMUM WITHDRAWAL AMOUNT/TIME | 5,000,000 VND | 1,000,000 VND |

INTEREST RATE | Fixed for the duration of the submission. Check it out here | |

INTEREST PAYMENT METHOD | Interest is paid to Savings Account as designated by the Customer at the end of the period or when the Customer withdraws before maturity | |

PREPAYMENT | Allowed to prepay part or all of the deposit before maturity and enjoy interest rates on demand | |

PAYMENT ON TIME / EXTENSION OF DEPOSIT TERMS | At the date of participating in the product, the customer chooses one of the following methods when it is due: - Automatic settlement, principal, and interest will be automatically transferred to Customer's Savings Account opened at Techcombank; - Automatic rotation of the original to a new term; interest paid to Customer's Savings Account; - The principal and interest are automatically revolving to the new term. | |

1

Vietnamese citizens are residents or non-residents

2

Foreigners are allowed to reside in Vietnam for a period of 6 months or more

3

Other provisions, details in Terms and Conditions cum the flexible principal withdrawal deposit agreement

Frequently Asked Questions

No. As for the already opened Flexible Principal Withdrawal Deposit account, the Customer cannot deposit more money into the deposit itself.

The principal/interest is paid to the Customer's Savings Account opened at Techcombank at the end of the term or when the Customer withdraws all or part of the principal before the maturity date. The default interest-receiving savings account is the account selected by the customer to deduct money at the time of registration to open the Flexible Withdrawal Deposit or the account that the customer designates to receive payment upon pre-payment/withdrawal.

The interest rate applied to the Flexible Withdrawal Deposit is fixed throughout the deposit term. In case the customer withdraws a part before maturity, the interest rate determined at the time of deposit opening is still preserved for the remaining balance of the deposit until the due date.

In case the customer withdraws before maturity, the demand interest rate will be applied, up to the lowest demand deposit interest rate issued by Techcombank at the time of payment of the early withdrawal deposit for the amount withdrawn before maturity. according to the actual number of days to maintain the pre-mature withdrawal balance.

Customers are allowed to withdraw as many times as they want without any limit on the number of withdrawals. However, the minimum withdrawal amount is 5 million for the over-the-counter channel and 1 million for the online channel and must ensure to maintain the minimum deposit amount on the account at 5 million for the over-the-counter channel and 1 million for the online channel.

Okay. The customer can change the payment account to receive the principal but must ensure that the account is the customer's own and opened at Techcombank.

- Transaction channel at the counter: Customers can make a change request at any time during the deposit period.

- Online transaction channel: Customers can change account information to receive interest at the time of withdrawal.

1

2

3

4

5