Attractive and transparent

The iFund is a open-end fund as it invests in bonds and stocks of the leading prestigious corporates

Attractive investment, comfortable life

The iFund is a open-end fund as it invests in bonds and stocks of the leading prestigious corporates

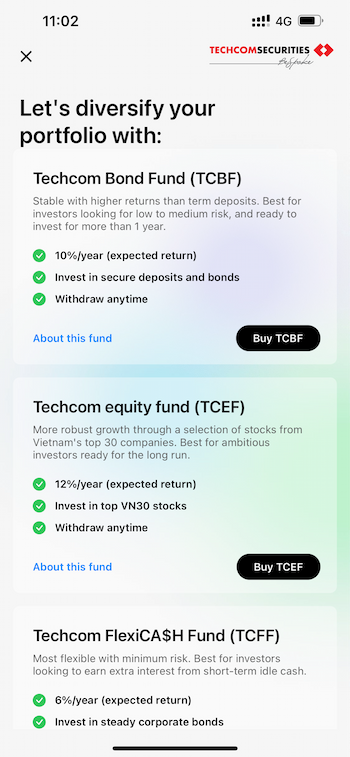

Expected return is up to 12%/year (*) with multiple types of open-end funds, in accordance with various risk appetites

Depending on a desire to invest, customers can flexibly choose how much they will invest in

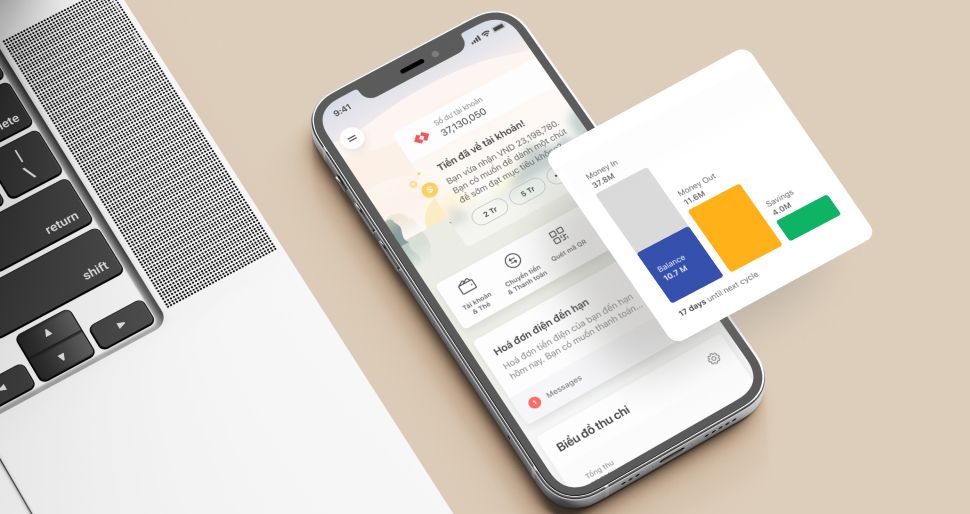

Experience convenient transactions with a high-tech system, good security, and 100% online

(*) Based on the estimated expected return of the portfolio and the current promotion. This expected return may be changed and not be indicative of future performance.

(*) Based on the estimated expected return of the portfolio and the current promotion. This expected return may be changed and not be indicative of future performance.

1

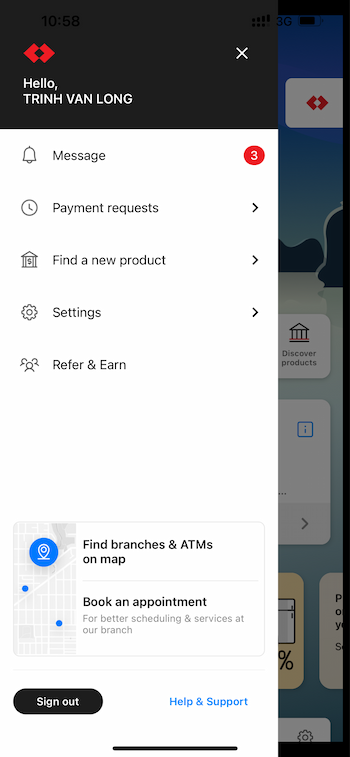

Login Techcombank Mobile app, then access to “Product Exploration” on menu bar

2

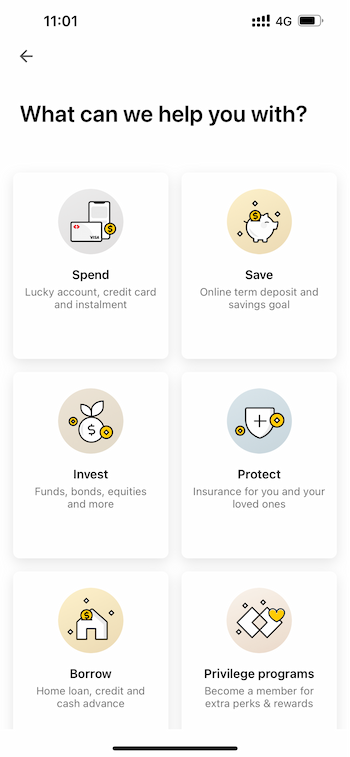

Select "Investment" item

3

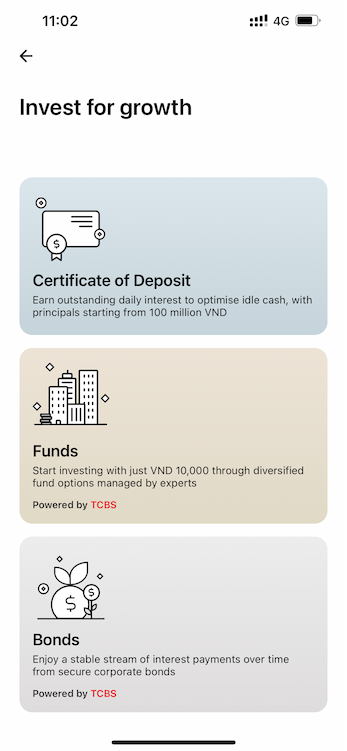

Select "Fund" in "Investment" item

4

You can select TCBF or TCEF

Refer to this video

Please refer to the trading fee for iFund at TCBS as following:

3. Transfer Fee

Transfer Fee to beneficiary bank account of customers after selling fund certificates is collected by Supervisory Bank as regulated

* According to service fees of Standard Chartered Bank

TCBF: Fee (not included VAT) is 11,000 VND for below 500 million transactions and 200,000 VND for more than or equal to 500 million transactions

TCBF: Fee (not included VAT) is 11,000 VND for below 500 million transactions and 430,000 VND formore than or equal to 500 million transactions

* According to service fees of BIDV

TCFF: 0,02% of transfer amount (not included VAT) , the minimum fee is 4,000 VND and the maximum fee is 100,000 VND

Refer to this video

Refer to this video