Easy and Convenient

Save anytime, anywhere within one minute on your mobile, or deposit/withdraw your savings easily at all Techcombank branches

Save anytime, anywhere within one minute on your mobile, or deposit/withdraw your savings easily at all Techcombank branches

Pay interest at maturity, immediately upon deposit, monthly and quarterly

Diverse terms tailored to every customer's needs

| ORDINARY SAVINGS | PHAT LOC SAVINGS | SAVINGS WITH PRE-PAID INTEREST | ||||

|---|---|---|---|---|---|---|

TRANSACTION CHANNELS | At the counter | Techcombank Mobile and Internet Banking | At the counter | Techcombank Mobile and Internet Banking | At the counter | |

CURRENCY | VND, USD, EUR, AUD, GBP, JPY, SGD | VND | VND, USD, EUR | VND | VND, USD, EUR | |

MINIMUM DEPOSIT | 1 million VND or 100 foreign currency units | 1 million VND | 5 million VND or 500 foreign currency units | 1 million VND | 5 million VND or 500 foreign currency units | |

TERM | From 1 to 36 months | From 1-3 weeks, from 1-36 months | From 1 to 36 months | From 1-3 weeks, from 1-36 months | From 1 to 36 months | |

INTEREST | Fixed during the deposit term Refer here | Fixed during the deposit term Refer here | Fixed during the deposit term Refer here | Fixed during the deposit term Refer here | Fixed during the deposit term Refer here | |

INTEREST PAYMENT METHOD | At maturity, periodically (Monthly/ Quarterly) | At maturity | At maturity | At maturity | Immediately upon saving | |

EARLY SETTLEMENT | Allowed to make final settlement before maturity and get non-term interest | Not allowed to make final settlement | Allowed to make final settlement before maturity and get non-term interest | Allowed to make final settlement before maturity and get non-term interest | ||

1

Transactions at the counter:

- VND Depositors: Resident or non-resident Vietnamese citizens

- Foreign currency Depositors: resident Vietnamese citizens

2

Online Transactions:

Depositors: resident or non-resident Vietnamese citizens and foreigners who have been allowed to reside in Vietnam for 6 months or more

VND

Month

1

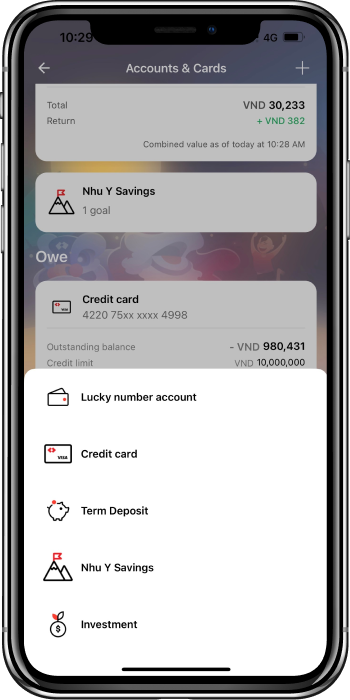

Login into Techcombank Mobile app. Click "Account for Debit Card

2

Click "New Account" and Click "Term Deposit"

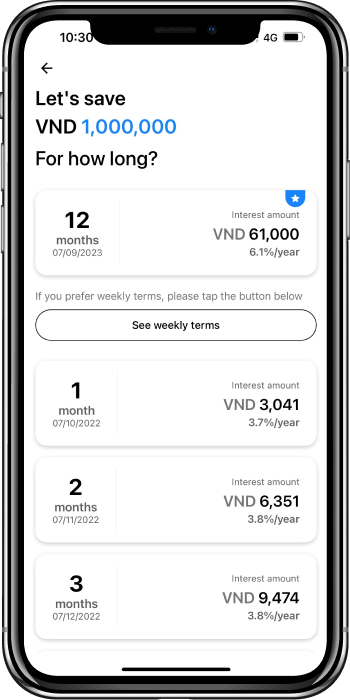

3

Input required information

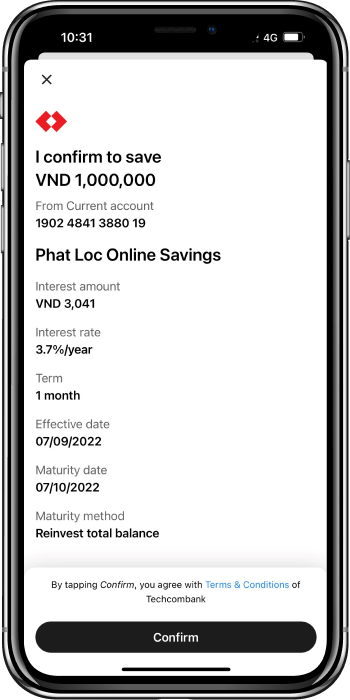

4

Check the information again and press "Confirm"

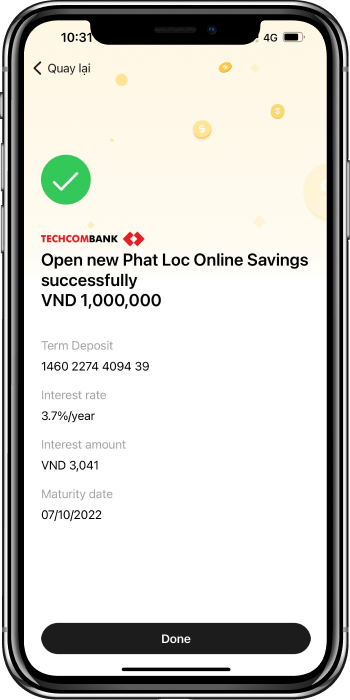

5

Your transaction is successful.

Customers are resident or non-resident Vietnamese citizens or foreigners who have been allowed to reside in Vietnam for 6 months or more

Yes, they can. Customers can make final settlement at the counter. Online Term Deposit accounts can be finalized for their Spend Account at Techcombank, then customers can withdraw cash from this Spend Account at the counter

If customers choose this payment method, they need to register for a Spend Account at Techcombank. Interest will be transferred automatically to their Spend Account when the term ends

- For Ordinary Savings product with interest paid at maturity/ Phat Loc Savings, if customers don't have any new requests, interest will be added to the principal and Savings will be lasted for one more term equivalent to the old term

- For Ordinary Savings product with interest paid periodically, the principal will be transferred to a new term equivalent to the old term, interest will be transferred to customer's Spend Account at Techcombank

With Ordinary Savings, customers can withdraw the principal before the term ends, but with Phat Loc Savings, customers can't. Normally, Phat Loc Savings interest is higher than Ordinary Savings interest. Therefore, depending on the needs and plans, customers will choose the most suitable product.