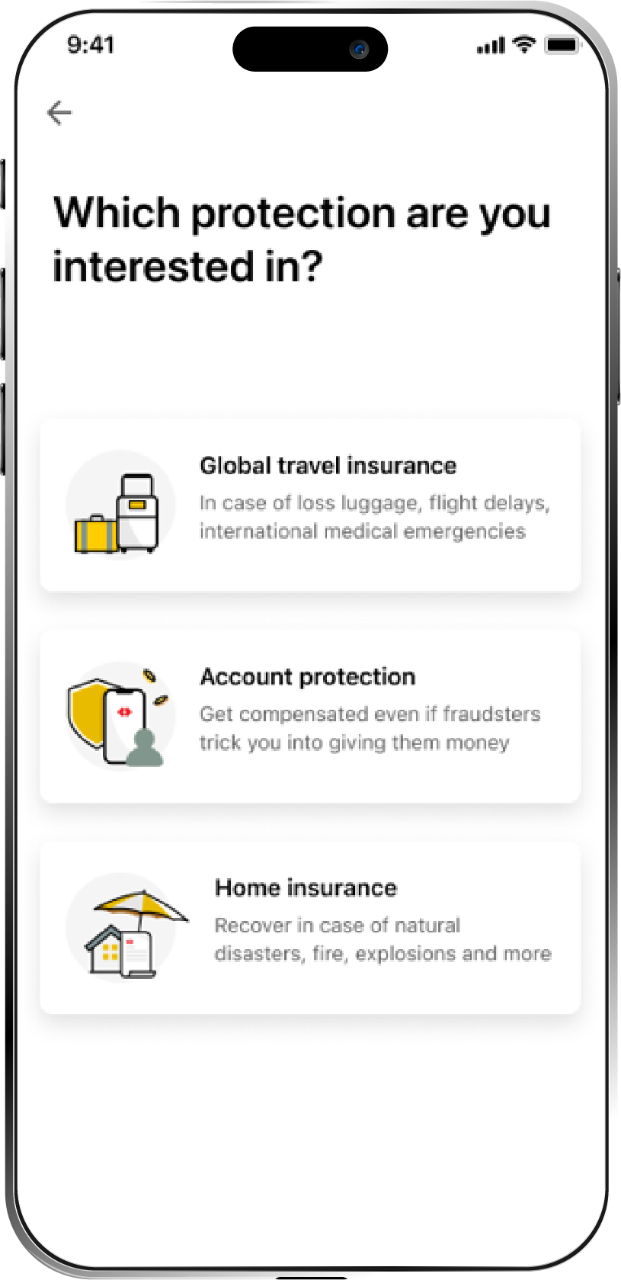

Protection against being tricked into transferring money to a fake account

If you transfer money away for being tricked by fraudster impersonating acquaintances, authorities, etc

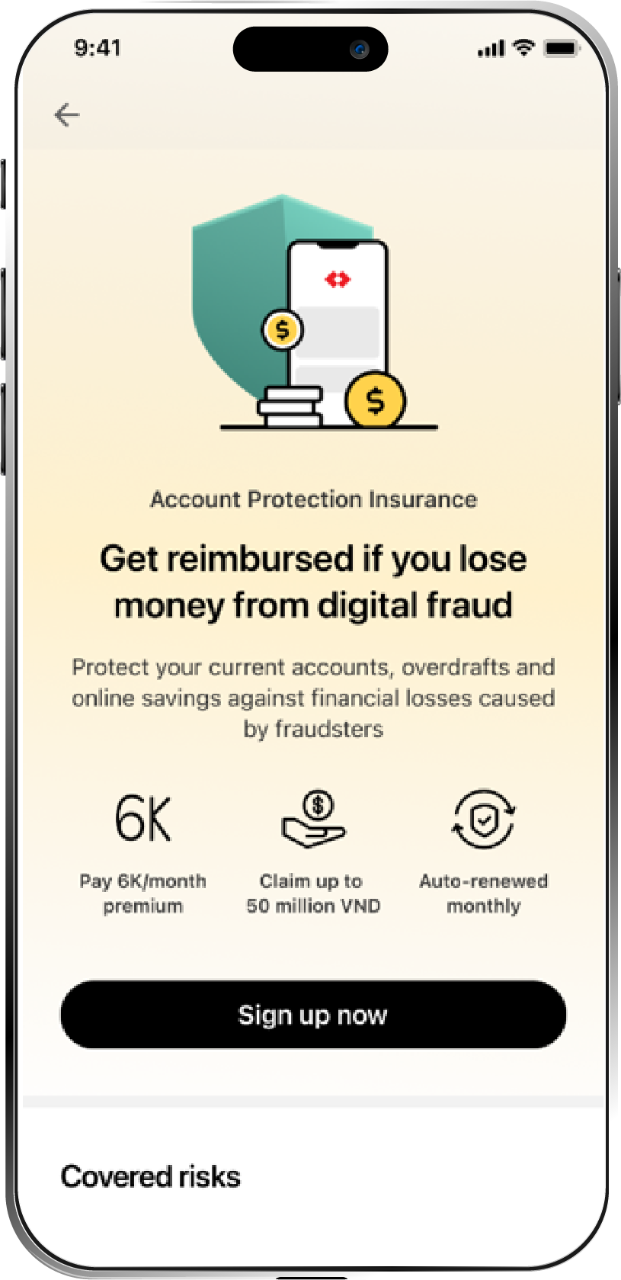

Safeguard your money, transact with ease,

and stay ahead of unexpected digital fraud

If you transfer money away for being tricked by fraudster impersonating acquaintances, authorities, etc

If you’re trick into providing account information on fake websites, access malicious links leading to account breaches and financial losses

1

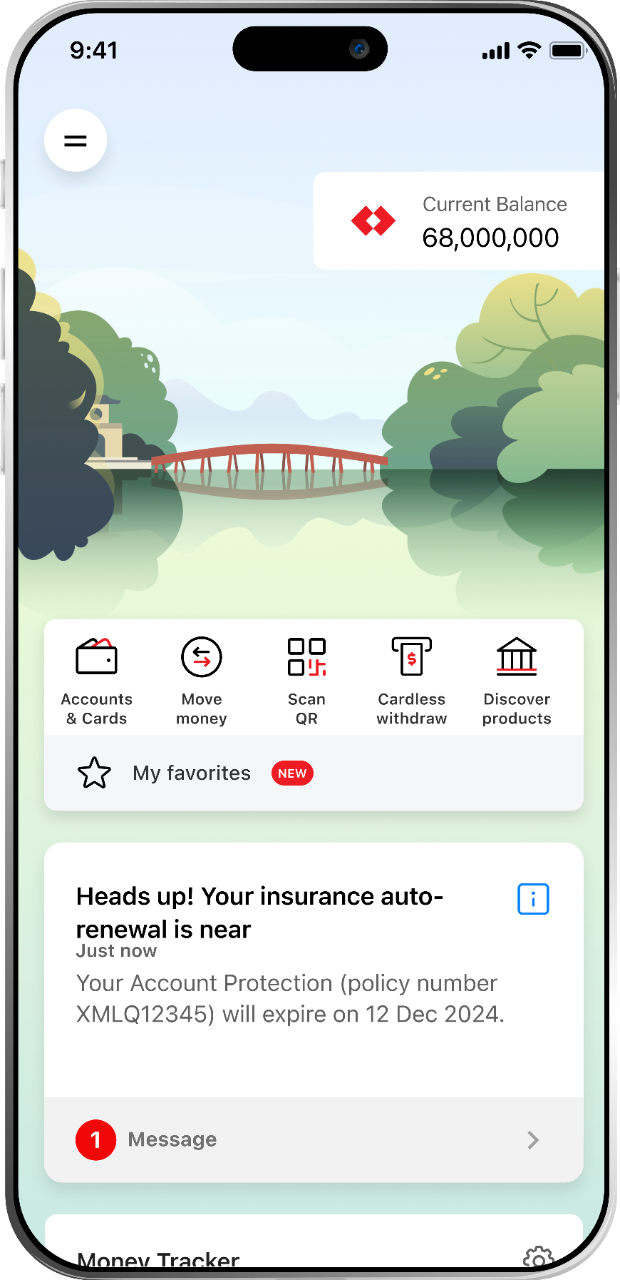

Log in Techcombank Mobile, on the dashboard go to “Discover products”

2

Go to “Protect” > Click “Account protection”

3

At the product page, choose “Join now”

4

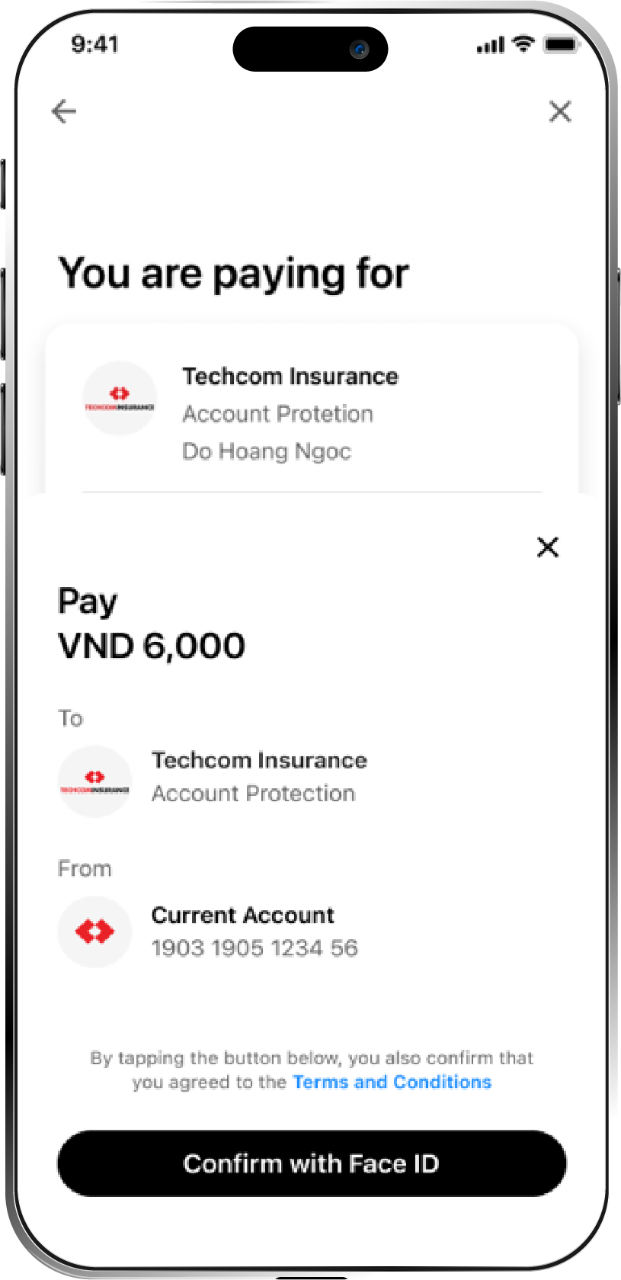

Read the product “Terms and Conditions” carefully

5

Complete your payment

Questions about the risks covered

Frauds via telephone, voice messages are outside the coverage.

Customer is paid for the loss in this case.

Customer is paid for the loss in this case.

Customers are not limited to the number of claims, however, the total amount of compensation for customers will not exceed the level of liability specified on the insurance certificate.

Financial damage arising from the wrong transfer of money will not be covered by the product, so customers will not be paid compensation.

Account Protection Insurance pays for all financial losses arising from the customer's current account, overdraft account and online savings. In this case, the customer is paid 50 million VND.

Customer is paid for the loss in this case.

Customers cannot pay compensation because the risk of losing physical cards is at the exclusion point of the product.

Customers are paid compensation for financial losses arising from online fraud risks and lost funds from the customer's payment account.

Customers cannot pay compensation because the scope of protection of the product does not pay for financial damage arising from credit cards.

Standard Insurance package is very competitive, only 6,000 VND per month and takes effect right after the insurance policy is issued. Therefore, the refund policy is not applicable

For the convenience of customers, the program has a provision for automatically renewing within the next 30 days. As soon as you successfully pay your fee, your account will continue to be protected.

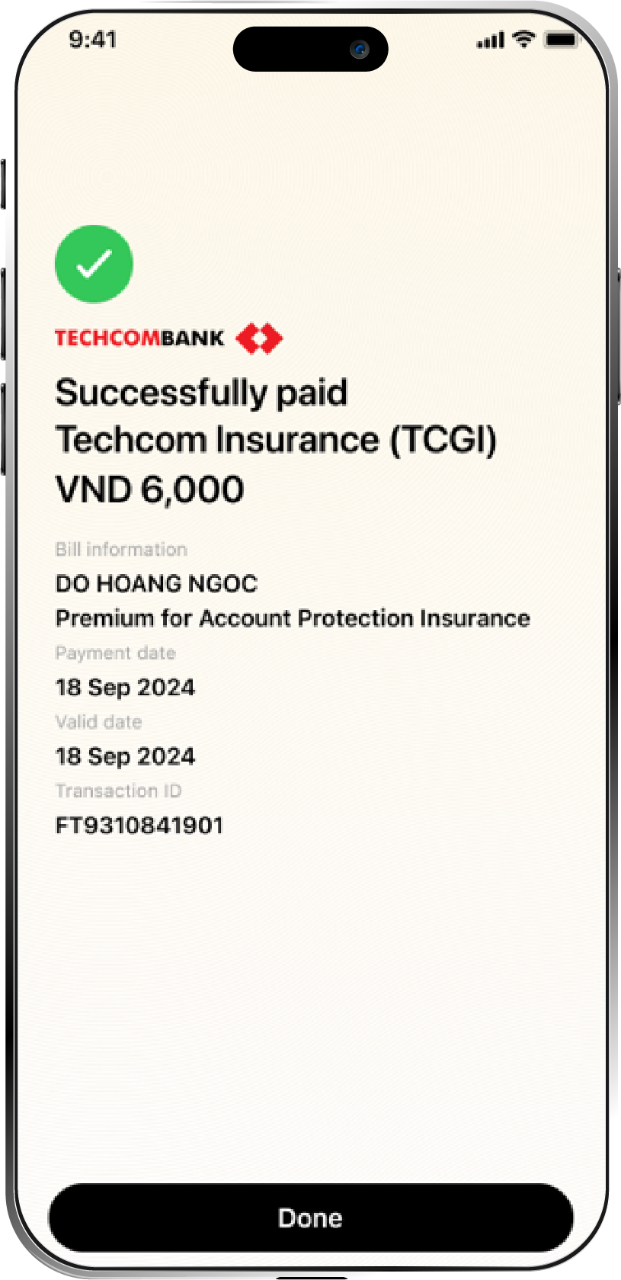

You will receive the electronic insurance certificate immediately after successful payment. To view the electronic insurance certificate, you can choose one of the following ways:

Customers can immediately receive electronic insurance certificate after successful payment.