According to the regulations of the State Bank, Techcombank is not permitted to repurchase CDs issued by ourselves.

However, a lot of customers engage in CD transactions due to its exceptional features regarding interest rates and trading platforms.

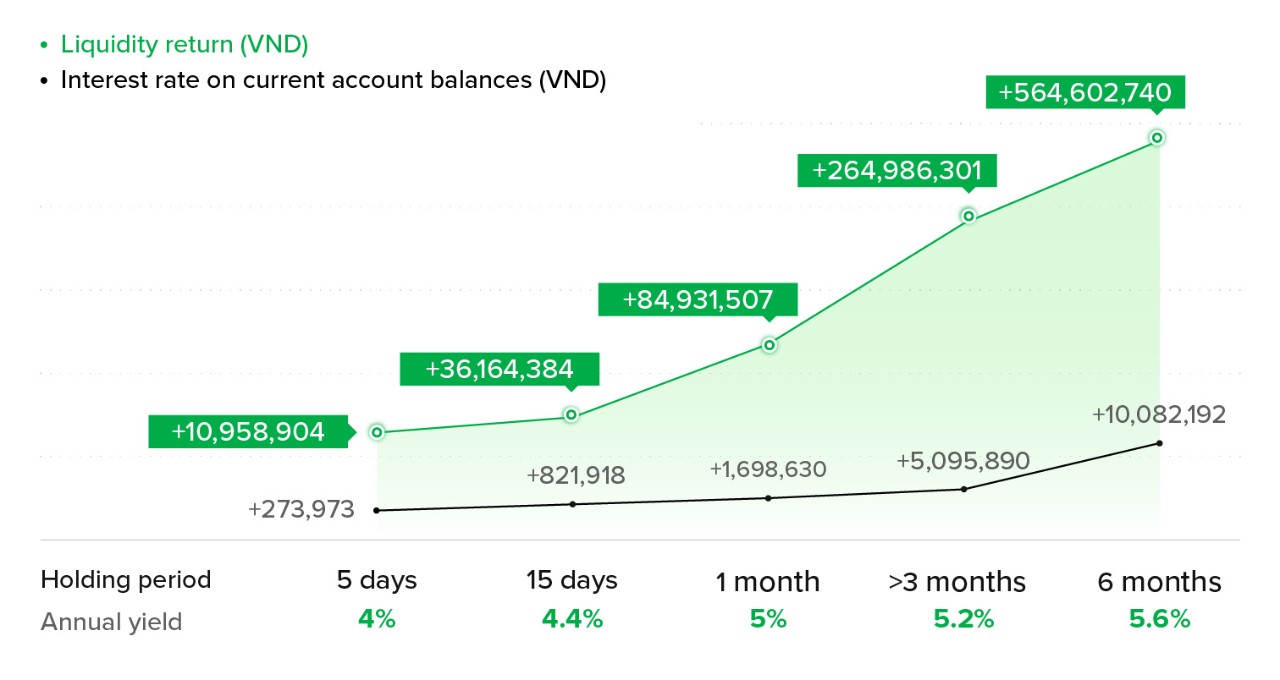

Techcombank will consider an exception allowing you to settle the CD before maturity and benefit from a non-term interest rate for a period of time from the date of buying till the date of selling, in the event that your business is unable to find a partner to transfer and needs to withdraw capital immediately.

Bao Loc CD is just as safe and insured as a savings deposit, and it has the same value.