Cost efficiency

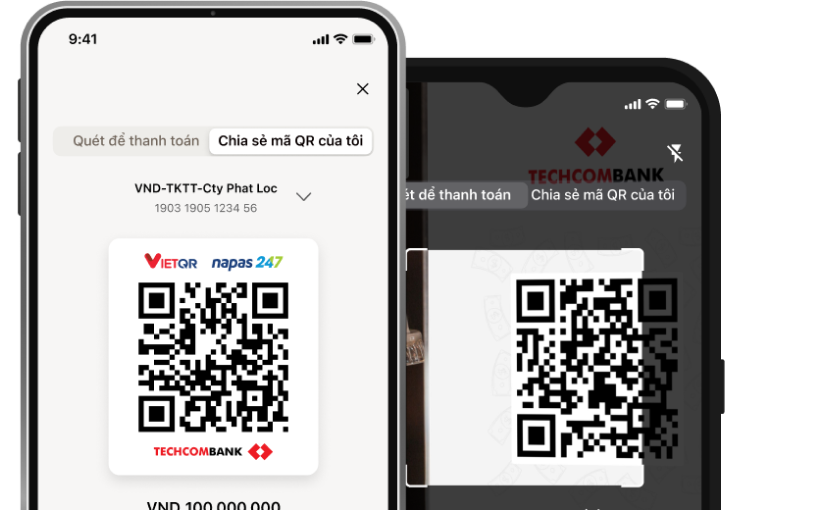

Free lucky account number, management fees, annual fees, transfer fees.

1

2

3

4

Free lucky account number, management fees, annual fees, transfer fees.

Attractive interest rates with flexible deposit options for businesses.

Timely updates on the latest promotional programs and exclusive offers.

1

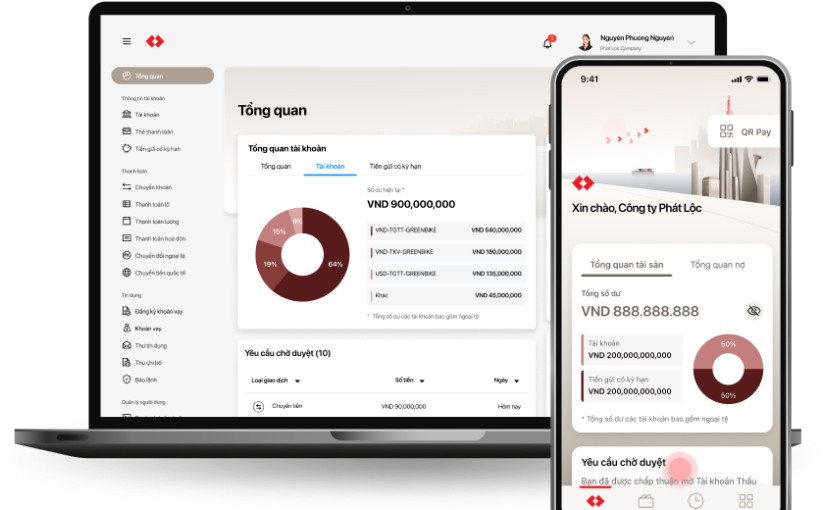

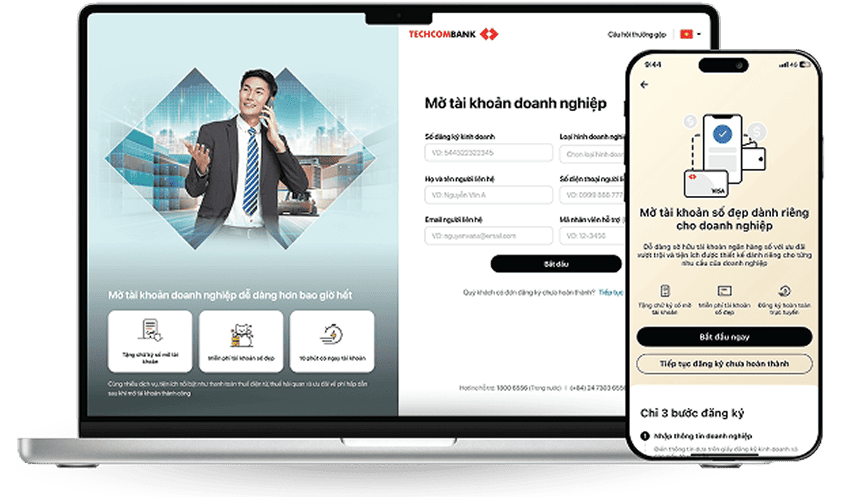

Open a business account and register to use the outstanding utilities of Techcombank Business

Open an account: Here

2

- Log in at https://business.techcombank.com.vn/ with the username sent to your email and the password sent to the phone number registered with Techcombank

- Update your password and enter the OTP authentication code

3

- Download and install Techcombank Business from the App Store / Google Play

- Log in and enter the OTP authentication code for the first registration

- Register for facial recognition/fingerprint recognition to log in faster

- Create a security code to complete account activation

1

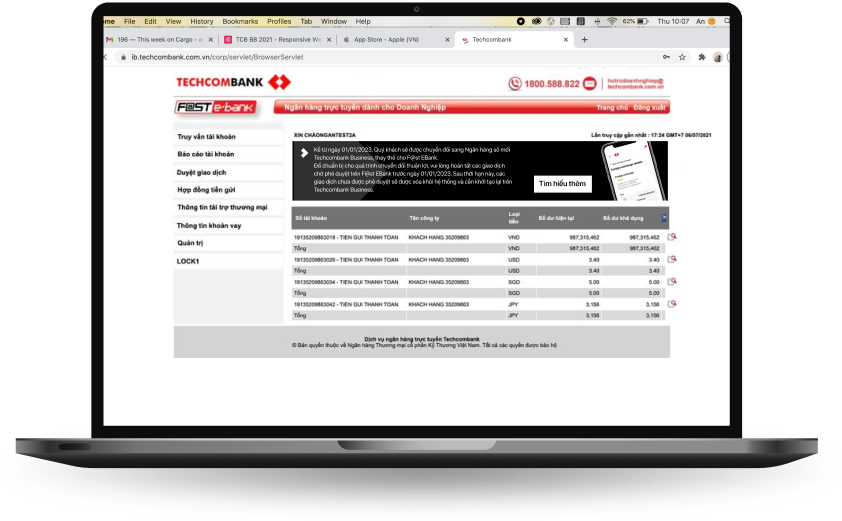

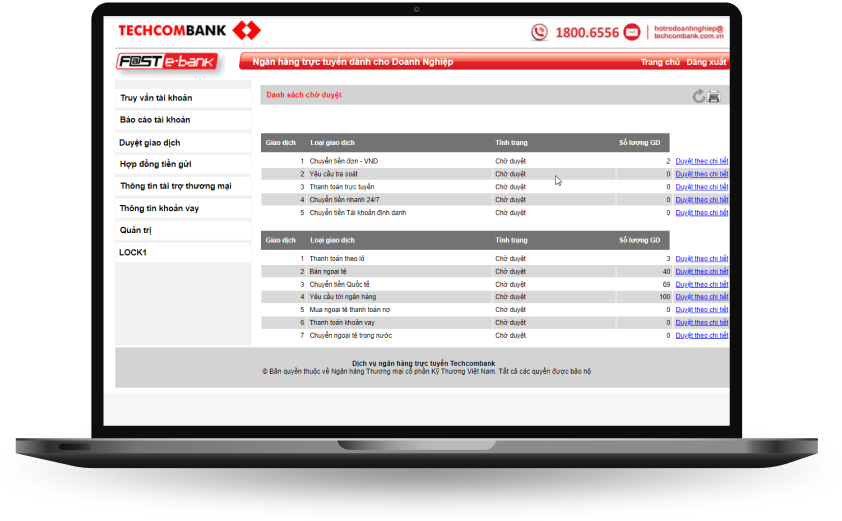

Techcombank will transfer customers in phases. Please continue to use and follow your business's details on F@st EBank

2

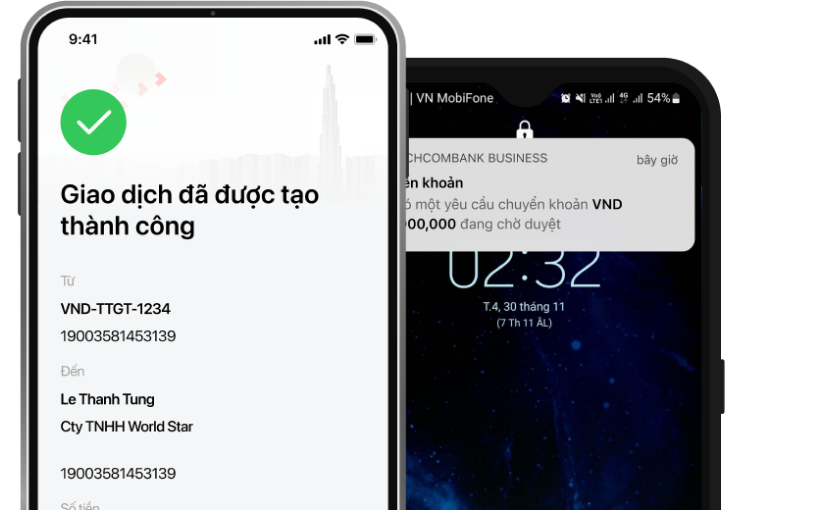

- Complete transactions that are pending approval on F@st EBank. Once the switch process has started, these transactions will be automatically deleted and will need to be restarted on Techcombank Business

- The phone number receiving the OTP code to verify the first login on Techcombank Business will be the number already registered with Techcombank

3

- Once the switch has been successfully completed, you will receive an email notification from Techcombank. Please vist F@st EBank, select Transfer to Techcombank Business to log in to the new platform with your current account and password

- Update your password and enter the OTP authentication code sent the phone number registered with Techcombank

4

- Download and install Techcombank Business from the App Store / Google Play

- Log in and enter the OTP authentication code for the first registration

- Register for facial recognition/fingerprint recognition to log in faster

- Create a security code to complete account activation

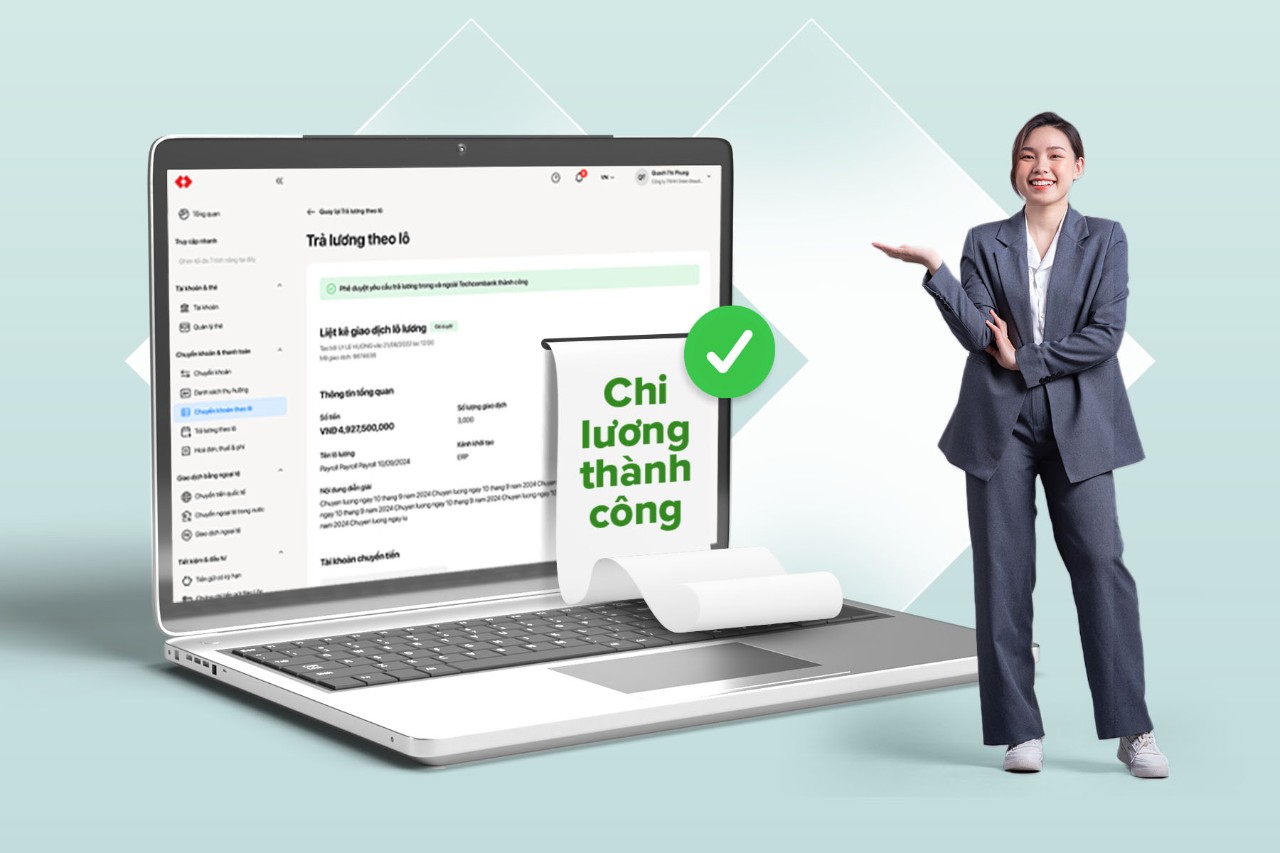

Unlock a host of financial perks, from cash back and flexible loans to exclusive membership upgrades for both your company and its employees when you sign up for payroll services with Techcombank.