ESMS framework at Techcombank

We have actively researched, developed and implemented programs and policies to encourage lending to ‘green’, eco-friendly projects and increased the number of these in our loans portfolio.

Some of our business development activities in key economic sectors are oriented towards renewable energy projects such as wind, solar and biomass power. These are among the Bank’s priority sectors for the coming years.

Based on IFC standard

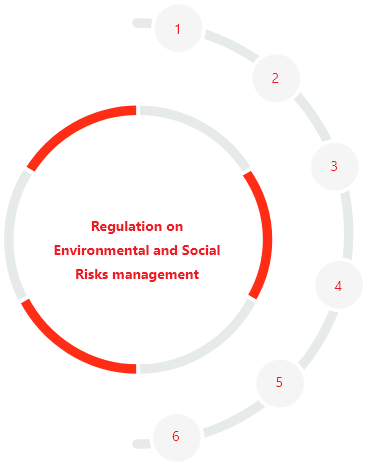

Our ESMS framework was developed by the Techcombank Board to support high-level principles and requirements at all stages – from assessment, appraisal and approval to risk monitoring and control after disbursement. Day-to-day procedures, guidance and decisions on credit approvals are overseen by the CEO and Heads of Divisions.

- 1.General principles of assessment, rating and approval of Environmental and social risks (E&S risk) (including transactions).

- 2. Requirements for E&S risk rating: rating criteria, requirements for assessments and rating (in the Report on Customer appraisal) Requirements on E&S risk appraisal: including appraisal at Business Units and independent appraisal at Risk Management Division.

- 3.Requirements for E&S risk approval: all documents with Group A rating (High risk with potential significant adverse environmental or social risks and/or impacts that are diverse, irreversible, or unprecedented) must be approved by the E&S risk experts at Risk Management Division.

-

4. Requirements for post-disbursement controlling and

monitoring and E&S risk reporting:

- (i) Relevant units must submit reports to Head of Business Divisions, E&S risk experts and the E&S risk management officer of Risk Management Division for handling if they detect customers violating provisions of laws, commitments, regulations and conditions of Techcombank.

- (ii) The reports are prepared by the Appraisal Unit of Risk Management Division and E&S risk management officers.

- 5. Roles and responsibilities of individuals and related departments: customer relationship officers; units and individuals with post-disbursement controlling functions; E&S risk experts; department/unit in charge of E&S risk under Risk Management Division.

- 6.Guidance on E&S risk rating ranging from

Group A, B and C:

- Group A is classified as High E&S risk and will required proper assessment for E&S;

- Group B is deemed as medium risk with potential limited adverse environmental or social risks and/or impacts that are few in number, generally site-specific, largely reversible, and readily addressed through mitigation measures;

- Group C has low E&S risk with minimal or no adverse environmental or social risks and/or impacts.

Sector and project classification for assessment and appraisal

We strictly comply with the IFC’s exclusion list and with Vietnamese regulatory requirements.

Sector and project classification guidelines, based on strict compliance requirements, are communicated to all credit officers.

COVID Support and other CSR

Since the begining of the COVID-19 pandemic, we have been among the pioneers in supporting the Government, businesses and the community, especially in Ho Chi Minh city and surrounding areas. In the context of this unforeseen event, we committed to not only ensure the safety of, and support our 12,000+ employees, but also to take more efforts to help the country overcome the pandemic. Within two years, we restructured nearly VND 11.8 trillion in loans. By the end of 2021 the balance reduced to VND 1.9 billion, equivalent to 0.5% of the outstanding loans. At Techcombank, we also assisted with interest rate reductions of VND 540 billion. To support communities, we contributed around VND 400 billion for activities including the COVID-19 Vaccine Fund, and funds for hospital construction, medical equipment and other direct help to patients and their families.

Other activities supported by Techcombank

In 2021 we commenced a new strategic journey with aspirations for innovation. We keep striving to realise our vision of Change banking, change lives through our business and social programs. Our vision enables us to encourage each Vietnamese person to unlock their potential and Be Greater.

In April 2021, Vietnam’s world-class running event – the Ho Chi Minh City International Marathon – took place for the fourth time. Techcombank sponsored and helped organise this event, which embodies our Be Greater ethos. Despite interruptions and postponements due to the pandemic, over 13,000 participants entered races of 5 to 42 kilometres, with the support and encouragement of local government, residents and organisers. Running can be enjoyed by many, regardless of age, gender, nationality or profession.

13,000 +

VND 2 billion

At the end of the event, our CEO, Jens Lottner, presented VND 2 billion as a charity to ‘For Greater Vietnam’ foundation.

In 2021, we donated about VND 400 billion for over 1,000 pieces of medical equipment especially for hospital in the southern region which was hit the most during wave 4, and funded COVID-19 hospital constructions in Hanoi and the northern provinces. In addition, the Bank funded the government’s ‘Fund for Vaccination and Prevention of Coronavirus Disease’ and supported disadvantaged households and labourers across 15 provinces and cities in Vietnam.

VND 400 billion

1,000

The focus for CSR activities in 2022

- We will continue to sponsor the Techcombank Ho Chi Minh City International Marathon, and create a Techcombank Hanoi Marathon, to encourage healthy lifestyles, self-development and a better Vietnam.

- We will always answer the call from the Government of Vietnam to community support – helping people and the country to overcome the COVID-19 aftermaths and responding any other public health emergencies that may arise.

- Finally, we will continue to uphold the human spirit by supporting Vietnamese people and communities through difficult circumstances and natural disasters, helping them recover and prosper.