Risk management

Prudent lending policy as per approved risk appetite helped to maintain CAR at 15.0%, NPL at 0.7%, and credit cost reduced to 0.7% (from 0.9% in FY20). We also successfully managed down nearly 80% of 2020 COVID-19 restructured portfolios.

2021 highlights

- We launched a market-leading omni-channel retail lending platform (Smart Credit), which reengineered the end-to-end process, to establish a more holistic view of customer information including both internal (lending and non-lending) and external sources.

- We continued to expand BCDE, our corporate commercial lending platform, which was designed and introduced to effectively automate and manage the credit management value chain for non-retail credit portfolios.

- Debt collection platforms and processes were enhanced to suit the ‘new normal’ and digitalisation of customer interactions is well underway.

- The launch of a market-leading fraud management platform that includes a powerful two-factor customer and card authentication process (Visa 3D secure 2.0) enables customers to shop safely in the ever-expanding e-commerce ecosystem.

We have actively researched, developed and implemented programs and policies to encourage lending to ‘green’, eco-friendly projects and increased the number of these in our loans portfolio.

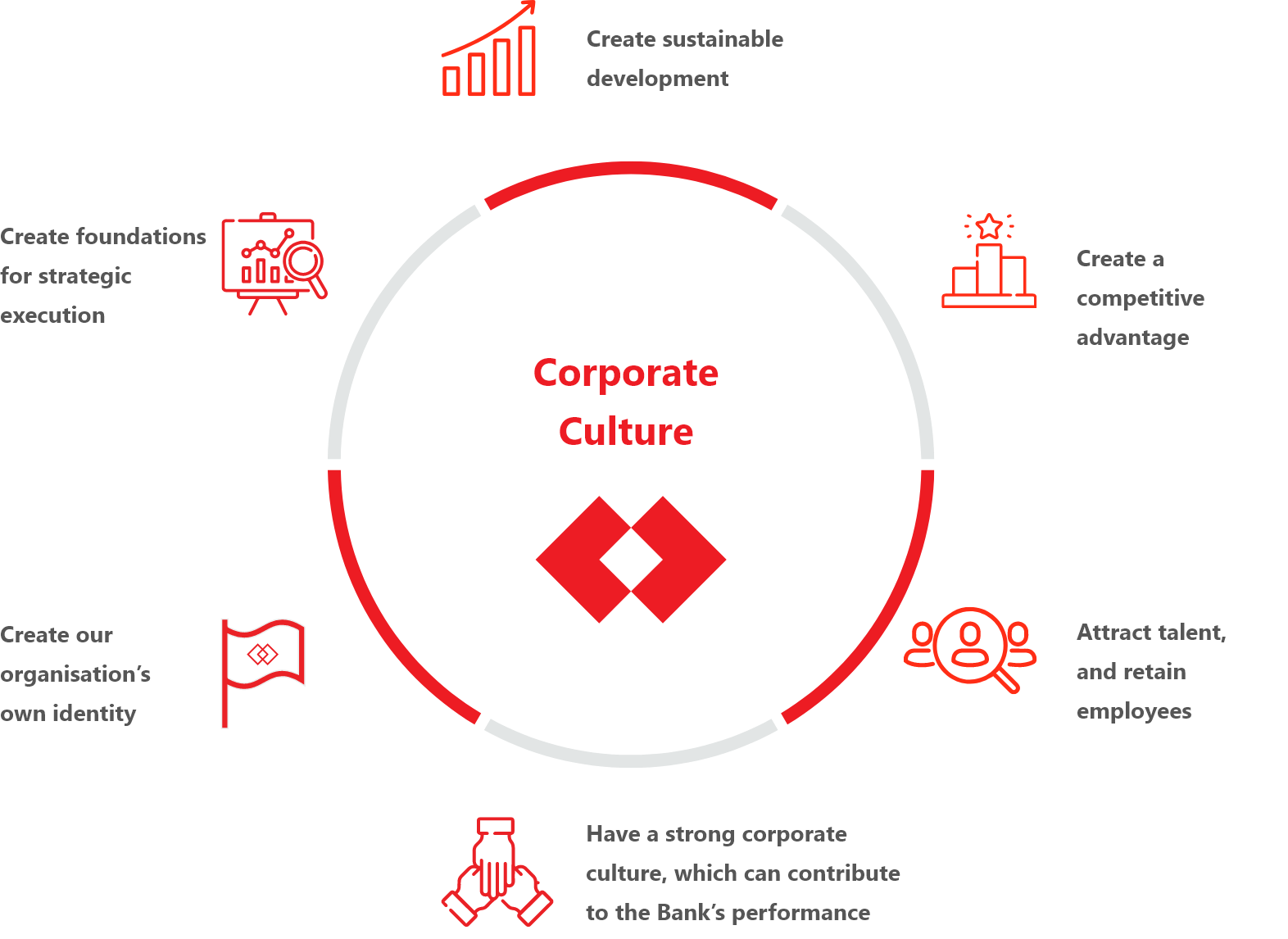

Corporate culture

Customer-centricity

Collaboration for common objectives

Innovation and creativeness

Self-development

Work efficiency

Our corporate culture is defined by five core values, which guide everything we do at Techcombank. They are:

Corporate

culture

-

Create sustainable

development -

Create a

competitive

advantage -

Create foundations

for strategic

execution -

Create our

organisation’s

own identity -

Have a strong corporate culture, which can contribute to the Bank’s performance

-

Attract talent,

and retain employees