Sustainability report

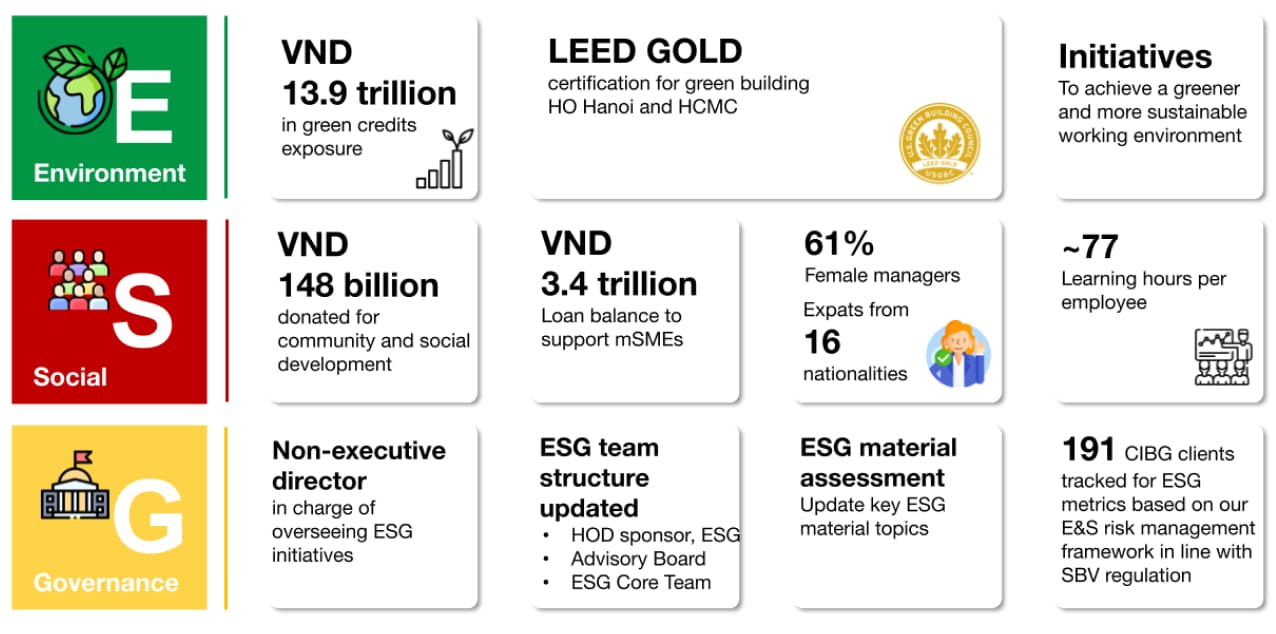

TCB's ESG key highlights in 2023

Vietnam context

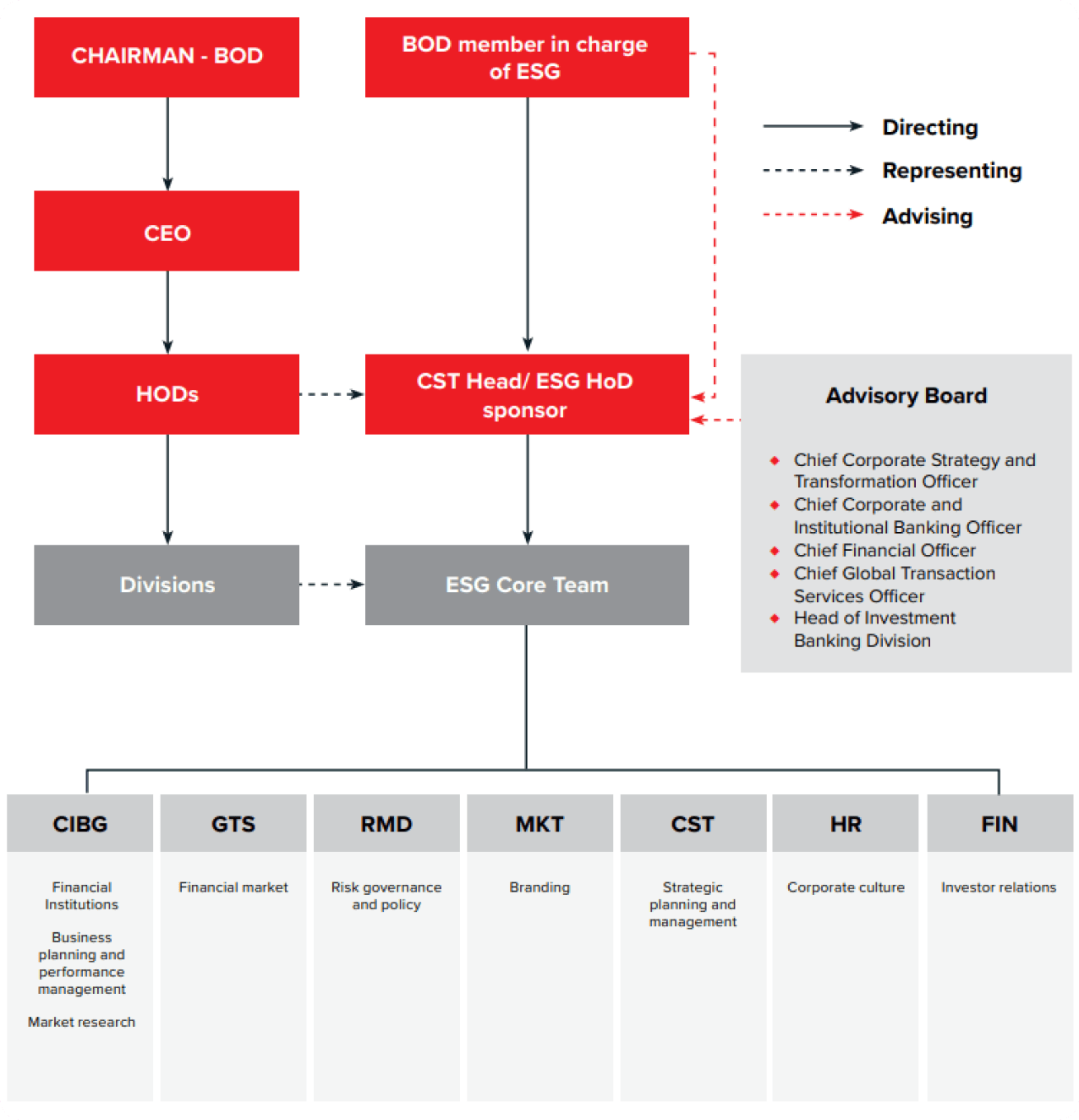

Techcombank's ESG framework

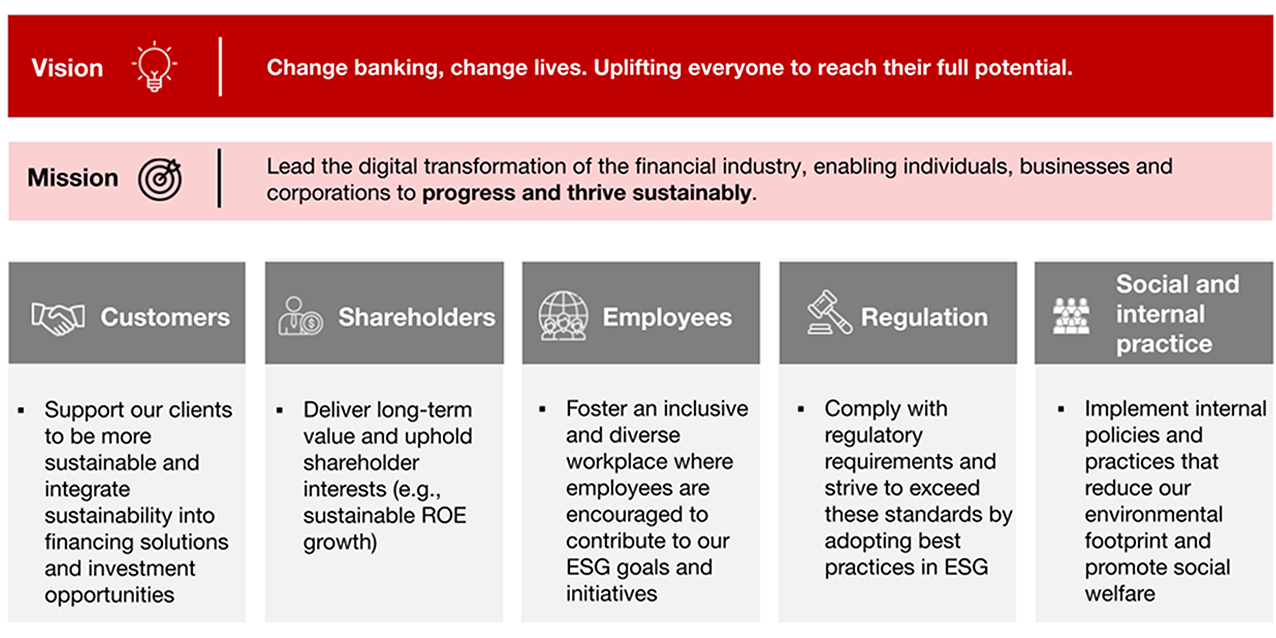

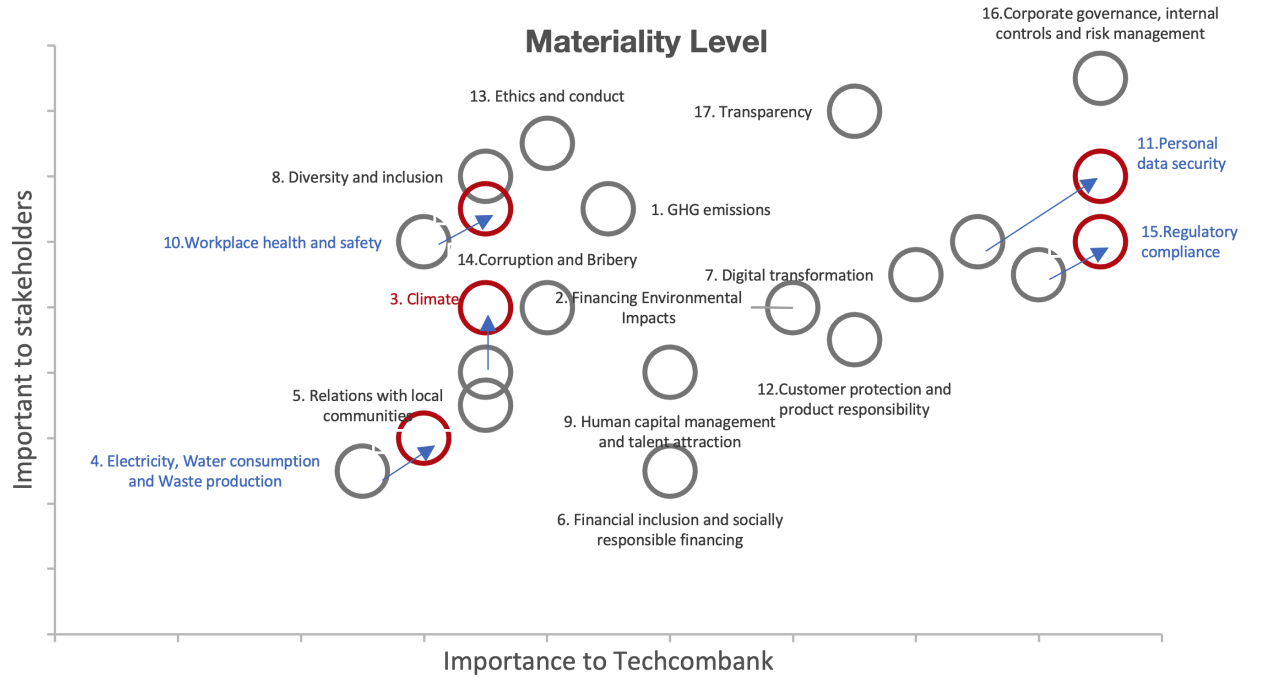

As we deepen our understanding of impacted sectors, we understand the increasing importance of this environmental impact on customers and become better able to support our clients to be more sustainable – considering ESG in their financial solutions and investment opportunities.

We track our power consumption and explore measures to optimise energy usage. The LEED GOLD certification we received for our two head offices can help create new standards for working environments in Vietnam. We have waste minimisation policies in place.

Our talented team are the Bank’s biggest asset and the foundation for our continued success. They deserve a healthy and safe workplace. The green, friendly working environments of our new head offices, with their Agile design, help optimise space and create open connections between employees so each person feels motivated toward self-development.

We continue to strengthen our technological capabilities, governance, internal processes and policies to protect our precious data from unauthorised access, use, disruption, modification, or destruction. We do all we can to safeguard who sees our customers’ personal information, such as their card numbers or account balances. Strict data security and privacy standards are crucial to protect the Bank’s reputation and ensure we remain deserving of our customers’ trust.

Our ability to comply with local regulatory and risk management frameworks. Our drive to meet international benchmarks, sets new industry standards for Vietnam.

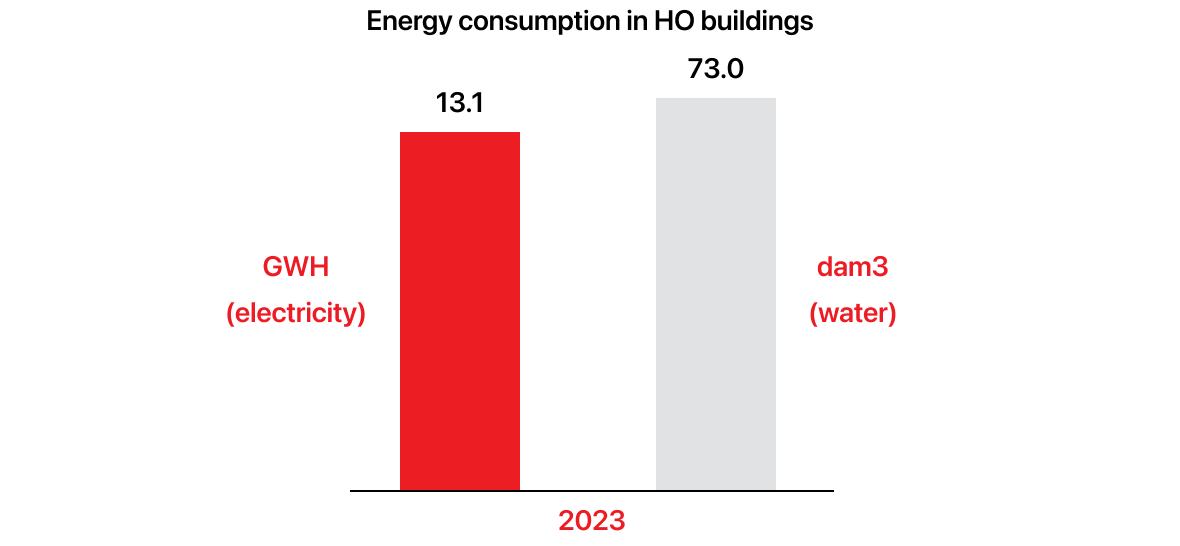

In 2023, Techcombank started operating two new world-class energy efficient office buildings (6 Quang Trung, Hanoi and 23 Le Duan, HCMC). Techcombank Tower in HCMC received the ‘Energy Efficiency in Construction Projects 2023’ Award from the Ministry of Industry and Trade and the Vietnam Energy Conservation and Energy Efficiency Association.

Recently, our two Techcombank Towers became the first Vietnamese banking headquarters to be awarded Leadership in Energy and Environmental Design (LEED) Gold by the U.S. Green Building Council (USGBC).

The below graph shows Techcombank’s electricity and water consumption for 2023. Now that we are established in our new offices, we will monitor our electricity and water use over time, using 2023 as a baseline.

As we streamline operations to make them leaner and more efficient, our reliance on consumables like office stationery and printer ink reduces. At the same time, we are eliminating passbooks, account statements and customer road trips to the Bank.

Our efforts to achieve a greener and more sustainable working environment, with various waste sorting initiatives, also continues. Techcombank staff are expected to minimise the waste they produce by ‘saying no’ to plastic, especially disposables. We encourage:

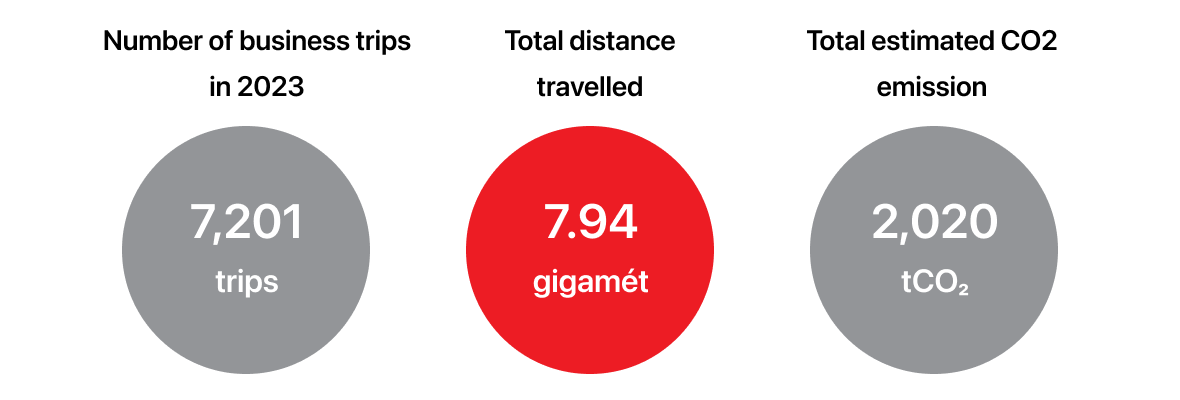

We pay close attention to the carbon admissions of business travel.

TCB pays close attention to the carbon emissions associated with business travel, through tracking and making travel program enhancements over the short and long term. We encourage eco-friendly transportation to reduce our carbon footprint a

Sector and project classification for assessment and appraisal

The environmental and social management system (ESMS) framework at Techcombank – based on requirements of the Environmental Protection Law, SBV Circular & international principles and standards:

Strategic direction on environmental and social policies at Techcombank:

Techcombank's social and environmental risk management requirements integrated in credit granting activities

Techcombank has updated the current Regulations and issued “Regulations on environmental and social risk management policies at Techcombank” effective from 1 June 2023. Accordingly, the Social Environmental Management System (ESMS) was also updated and completed, contributing to helping Techcombank continue to affirm its pioneering position in complying with legal regulations, while meeting business development goals and protecting the sustainable social environment, keeping ahead banking and financial market trends.

Talent is one of the three key pillars in Techcombank’s five-year strategy. We understand that human resources are a precious asset and pride ourselves on operating a workplace that:

Diversity and inclusion can bring many benefits to an organisation. These include faster problem solving, better decision making, increased innovation, greater employee engagement and better financial performance. Techcombank welcomes, and is expanding, opportunities for our multigenerational, multinational workforce; as well as encouraging and promoting gender equality standards. A culture of inclusivity helps us attract and retain talented people from all parts of the community.