TCBS aims to become The Orchestrator of capital flows in Vietnam. Our success is based on the Wealthtech financial technology strategy, building a comprehensive TCInvest ecosystem for investment and asset management. By the end of 2023, TCBS had served nearly 1 million customers, including individual and corporate customers. The journey of creating a superior comprehensive investment experience has helped TCBS stand out from others, and capitalise on the strong growth potential of Vietnam's financial market

Operational efficiency

In 2023, the Company's PBT surpassed VND 3,028 billion, exceeding the initial full-year plan of VND 2,000 billion by an impressive 51%. TCBS boasted an industry-leading PBT per employee of VND 6.27 billion in 2023, a staggering 4 times higher than industry average. This impressive figure marked a 2.7% increase compared to 2022.

TCBS boasted a 2023 cost optimisation score (Advanced CO Score) by AWS that surpassed both the average for Vietnamese financial services and the ASEAN benchmark.

| Standard | CO Score |

|---|---|

| ASEAN average | 43.8% |

| Vietnamese average | 37.9% |

| Vietnamese financial services average | 35.7% |

| TCBS | 54.3% |

Enhancing digital experiences with Wealthtech financial technology strategy

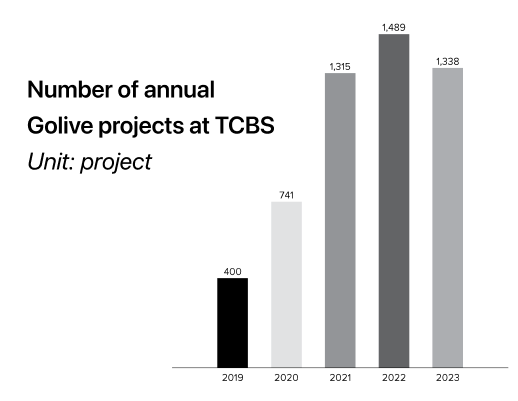

Over 52% of employees were IT-related and utilising the Scrum/Agile model for an efficient and adaptable way of working. In 2023, leveraging advanced technological methods and models, the Company significantly enhanced our Go-live capabilities, with 1,338 projects rolled out. Additionally, the TCInvest system demonstrated impressive performance, maintaining stable connectivity even with over 12.4 million visits per month, or over 400,000 visits per day.

In 2023, more than 95,700 customers opened accounts on TCInvest, bringing the total number of retail customers at TCBS to nearly 1 million.

Digital Wealth Manager of the Year Best Data

Analytics Project – TCAnalysis

Best Wealth Management and Private Banking Implementation: Best Program Vision

Best Wealth Management and Private Banking Implementation: Best Adopted Tools and Practices

Best Investment and Fund Management Implementation: Most Impactful Project

Most Innovative Analytics Deployment: Best Program Vision

Most Innovative use of Blockchain in Banking: Most Impactful Project

In 2024, we continue our 5-year strategic journey, with the goal of becoming The Orchestrator of capital flows in Vietnam. To maintain a leading position in core business segments, aiming to conquer the goal of being the securities company with the highest brokerage market share and best utilising our abundant capital to bring long-term value to customers and shareholders, in 2024, TCBS will continue to:

2024 will be pivotal in our journey to make TCBS the largest wealth management technology company (Wealthtech) in Vietnam in terms of equity, profit, and operational efficiency in our core business lines.

We continue to implement our long-term vision to make TCC the leading fund management company in Vietnam in terms of managed asset value and operational efficiency, building a smart and sustainable financial community, where everyone can achieve their financial goals by:

As part of the Bank’s commitment to innovative use of technology, both in Vietnam and internationally, Techcombank AMC is always improving its data management and information systems. It is a highly professional and essential part of the Bank’s end-to-end lending process. In 2023, Techcombank AMC:

In 2024, Techcombank AMC will continue to improve our measurement tools, especially using digital and data to: