Overview

The Bank’s ongoing strategic investment in digital platforms, digital acquisition and providing the best possible digital experiences has seen us attract ever larger numbers of new customers and offer them unique, data-enabled, hyper-personalised experiences. As we delve more deeply into our sea of data to gather insights and harness the power of AI and machine learning, we are continuously making every customer’s experience more bespoke. The ability to innovate and effortlessly increase the number of customers we serve, has led to more transactions being done online, costs in several areas being reduced and overall returns rising. Our multi-award-winning digital transformation has the Bank operating at new levels of efficiency and on track for future growth

2023 Highlights

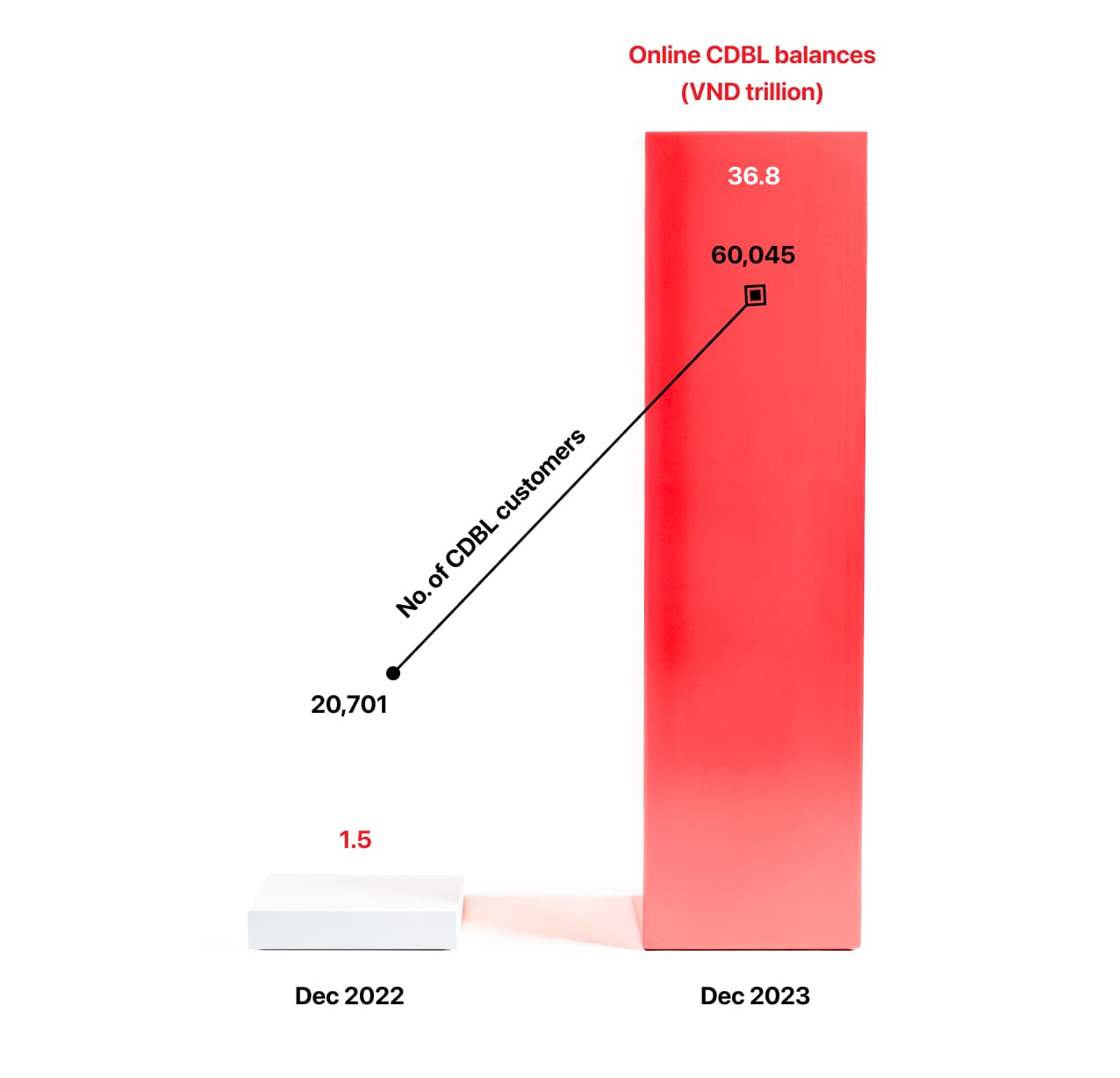

A prime example of simplifying our products was for our core wealth product, the Certificate of Deposits Bao Loc (CDBL). On the one hand we simplified the digital journey and on the other made it more accessible by reducing the minimum investment amount to only VND 10 million for retail customers (down from VND 100 million) and VND 50 million for corporates. This drove CDBL to more than 64% of total retail savings and 57% for corporate savings.

We were first to offer completely online banker’s guarantees for our corporate customers. The journey simplifies our customer’s day to day operations – beyond banking – by helping them leverage multiple documentary formats used in the industry. Since its launch in August, this innovative service has seen monthly growth of 50% in the value of banking guarantees and a 96% increase in applications, capturing 37% of the traditional product’s customer base.

In addition to simplifying our products, we made significant investments to unleash the power of our data to create hyper-personalised experiences across multiple channels; including our website, mobile apps and social media. We are aiming to provide each customer with bespoke interactions and accesses solutions that align with their individual needs.