Income drivers

Total operating income (TOI) was VND 40.1 trillion , down by 1.2% YoY, driven by a decline of NII, partly offset by the strong performance of net fee income.

Net interest income (NII)

Net interest income (NII) declined by 8.6% YoY to VND 27.7 trillion. However, 4Q23 witnessed a strong turnaround in NII, which grew 11.4% YoY after three quarters of contraction. The net interest margin (NIM) in 2023 narrowed to 4.2% from 5.1% a year earlier. The lower NIM was largely due to the higher overall cost of funds compared to 2022.

Net fee income (NFI)

In 2023, Net fee income (NFI) grew by 9.5% YoY to VND 10.2 trillion driven by strong performance from cards, Letters of Credit (LCs), cash and settlement fees, and FX while we introduced new initiatives to revitalise our Banca business.

In 2023, operating expenses rose moderately to VND 13.3 trillion, up 1.8% YoY, enabling the Cost-to-Income Ratio (CIR) to remain at a very healthy 33.1%. We put a strong focus on cost control throughout 2023, while still investing in our data and technology capabilities and the development of our employees.

Digital and Data

We continued to invest in the adoption of cloud services, pioneering the use of AI capabilities to increase work efficiency, enable faster decisioning and deliver more personalised experiences for our customers. Overall, our technology and infrastructure expenses increased 45.9% in 2023, reaching VND 2.3 trillion.

Talent

Talent is one of the three core pillars of Techcombank’s transformation strategy, and we continued to invest in training programs for our employees so they could gain new skills and reach their full potential.

Marketing and promotion expenses

Marketing costs decreased by 29% YoY in 2023, in line with the overall operating environment.

The implementation of a dedicated customer experience panel allowed us to be more targeted and effective in the design of our campaigns and offerings, driving enhanced customer engagement and loyalty.

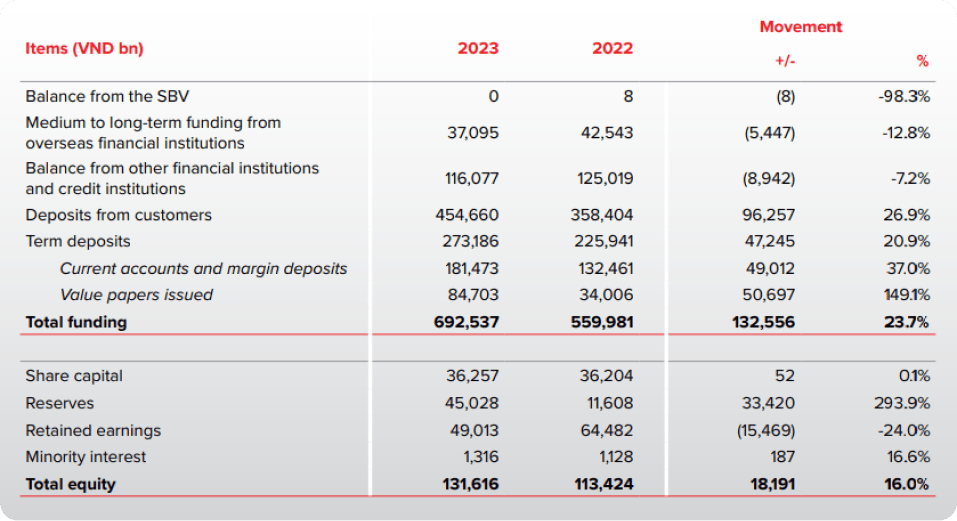

Robust funding position and positive CASA momentum

Despite tighter liquidity conditions in 2023, which led to higher term deposit rates, Techcombank successfully expanded total deposits from customers by 26.9% to VND 454,661 billion, while keeping our cost of funds among the lowest in Vietnam’s banking sector.

A big contributor to our CASA momentum was our value-chain approach, which is helping us capture an increasing share of the funds in our corporate customers’ ecosystems.

Among retail customers, our market-leading digital capabilities and our ecosystem partnerships helped us to add around 2.6 million new customers, contributing around VND 6.7 trillion to CASA growth.

Strong credit demand from corporate customers – more subdued in retail sector

At the Bank-only level, customer credit grew 19.2% YoY to VND 530.1 trillion, per quota granted by the State Bank of Vietnam.

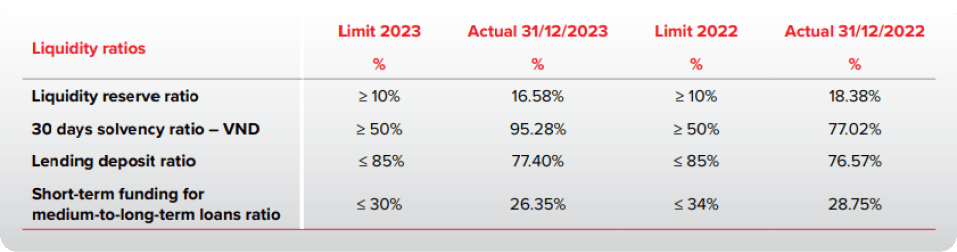

Liquidity management

In addition to the liquidity ratio limits as regulated by State Bank of Vietnam, the Bank has developed internal liquidity management indicators and early warning triggers following advanced international standards such as Basel III.

Asset quality

Overall, in 2023, the Bank’s asset quality remained within our appetite and in line with projections for Special mention and Non-performing loans (NPL).

Our coverage ratio at the end of 2023 was over 100%, reflecting the high proportion of secured loans in our portfolio and the strong value of the collateral held against these loans. Overall, Techcombank was the only large bank in Vietnam to report a reduction in the volume of our delinquent assets in 2023.

Capital management

Techcombank’s Capital Adequacy Ratio (CAR) as at 1 December 2023 was 14.4%, well above the Basel II, Pillar I minimum requirement of 8.0%. Our funding structure improved, with deposits from customers representing 73% of our total funding as of 31 December 2023, compared to 67% a year earlier.

Techcombank ended 2023 strongly and this momentum is expected to continue in 2024 as Vietnam’s economic recovery gathers pace.

While the global economic and geopolitical environment is likely to remain volatile, Vietnam’s economy is forecast to accelerate and achieve GDP growth of around 6% in 2024.

In 2024, our business initiatives will continue to follow the Bank’s Strategic Plan, and we will dial up the pace in three priority areas, being the expansion of our CASA deposits, the diversification of our credit portfolio, and the acquisition of Main Operating Account relationships.

Techcombank enters 2024 in a position of strength, with a strong balance sheet, robust asset quality, a leading CASA ratio, and an increasingly supportive operating environment.

The acknowledgement that Techcombank has reached a new level in terms of strength, resilience and profitability is the reason which led the management to recommend the first-time payment of a cash dividend to the Annual General Meeting (AGM) of shareholders.

Overall, we are aiming to achieve double-digit growth in both TOI and PBT in 2024. This performance, complemented by the exciting prospect of a cash dividend and the launch of more innovative and tailored offerings means that it should be a "Be Greater" year for our shareholders, customers and all our stakeholders.