Chapter 4 - The Transformation of Tech

IT Division

“By building on our IT systems, DevSecOps approach, governance and risk management frameworks, we created great value for customers and our workforce, bolstered by strong /en/investors/annual-report/2022/talent development initiatives.”

Chief Information Officer

Nguyen Anh Tuan

Overview

In 2022, IT Division continued to modernise the Bank’s systems to support more efficient operations and drive improvements to our customers’ digital experiences.

Our customers trust the Techcombank brand and remain at the forefront of our IT investment strategy. We sought innovative ways to deliver simple, intuitive and secure banking. Our focus was on:

execution excellence and transformation

Compliance and Risk management

creating customer value

IT /en/investors/annual-report/2022/talent

2022 Highlight

Execution excellence and transformation

Best-in-class technologies

We continued to invest in the best possible technology to accelerate our ‘Cloud First’ and digital strategy. In 2022, the cloud supported use of programs such as:

- Oracle for Anti-money laundering

- Backbase for our digital transaction banking platform

- Salesforce for customer relationship management (CRM)

- Moody’s CreditLens for our business credit decision engine

- Finastra’s Kondor for asset and liquidity management

- SAP HR for managing human resources.

IT system upgrades

Core banking IT systems were upgraded.

The upgrade of our Card Management Systems

Business Process Management

Software-defined networking

Software-defined wide area network

Modernisation of Enterprise Service Bus

Office 365

Change Advisory Board

IT Executive dashboard

IT Service Performance

DevSecOps

- 66% of our existing workloads have been converted to DevSecOps

- 91.2% of new systems/ applications have adopted DevSecOps

- New enhancements adopting DevSecOps grew 374% between the first and second half of the year.

Compliance and risk management

Security management

In line with Asia’s alarming cyber security trends, the Bank recorded over 23,000 attacks in 2022, 2.5 times that of 2021. However, our IT Security team’s prudent approach, bolstered by robust capabilities, ensured that all were unsuccessful.

- ISO/IEC 27000:2013 certification on Information Security Management for Core Banking and Internet Banking Services, valid from 29.10.2021 until 28.10.2024

- PCI DSS (Payment Card Industry Data Security Standard) certification version 3.2.1 at Level 1 (the highest compliance level), valid from 25.11.2022 until 24.11.2023.

In October 2022, our IT Security team won third prize in the DF Cyber Defence competition, organised by the National Cyber Security Centre and SBV.

Operational Risk management

In parallel, security violations reduced from 2021 by 14%.

Creating customer value

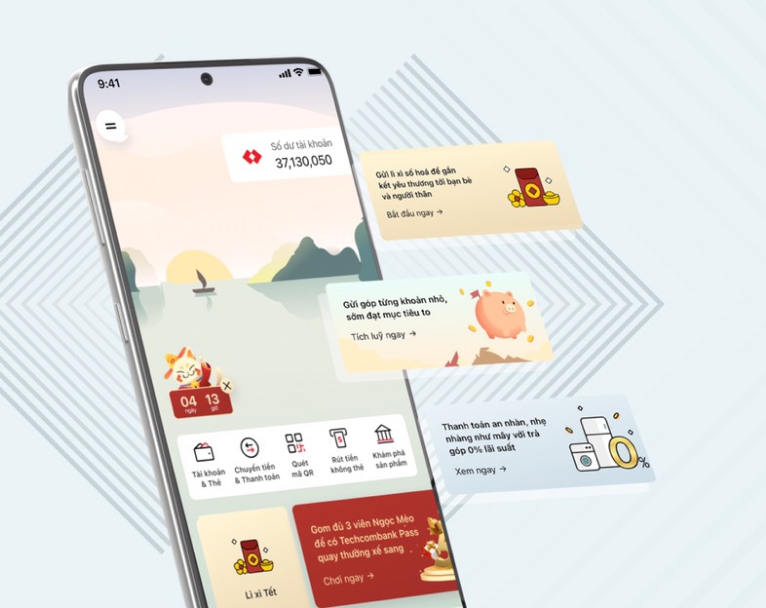

Techcombank Mobile Application

Powered by Backbase, it is the first mobile app in the Vietnamese market using big data to offer a tailored, personal financial management tool.

↑ 21.2% Techcombank e-banking customers ~ 6.2 million customers

↑ 15.7% e-banking transaction value ~ VND 10.5 quadrillion

↑ 29.6% e-banking transaction volume ~ 845 million transactions.

Techcombank Business Application

This year Techcombank:

Migrated 61.3% SME/MSME customers to the new app

Averaged a monthly 159.5% transaction growth

Averaged a monthly 138.8% transaction value growth.

IT Talent

Amazon Web Services (AWS) training and certification program

As part of our five-year cloud technology investment, 2022 saw us collaborate with AWS and their Skills Guild framework to train and upskill 2,800+ employees, recording 3,400 class attendances. Our innovative training program was a first for the region and saw 531 IT employees become certified.

Techcombank Future Gen in Tech and Data

The very successful first Future Gen – Tech and Data program commenced in January and our first student cohort have completed 12 of their 18 months.

MAs have doubled since the program’s launch. We received 1,300 applications for the second program (up 50% from 2021) and seven MAs commenced in January 2023 (up 38% from 2021).

Other staff development initiatives

- International Certification sponsorship program

- Learning via international e-learning platforms

62%

IT employees

completed at least 1 International Certificate

>1,000

Certificates

awarded from world-class institutions

The focus of IT for 2023

We will focus on improving the Bank’s IT systems to enhance productivity, efficiency and our customers’ banking experience. We will aim to:

- Accelerate operational excellence through the Bank’s five-year strategy with ‘Cloud First’ workplace modernisation, DevSecOps transformation and agile adoption

- Excel in IT governance and compliance with international standards by applying the COBIT 2019 framework

- Deliver value for customers by continuing to apply the latest technology-based services and products and bolstering customer security

- Continue to invest in the best digital /en/investors/annual-report/2022/talent and capability building.

Technical tests were conducted on IT employees from six job families in 2022. These results will inform technical skill-up campaigns to bridge identified gaps in 2023. We’ll focus on key skills such as:

- Business analyst

- Programming

- API design principles and patterns

- Automation testing

- DevSecOps tools

- IT services management

- Customer mindsets

- Cloud

- Terraform.

Besides skill-up campaigns, we’ll continue fostering a learning culture. Our objective is continuous communication/ gamification and public recognition. We’ll build and promote a culture of sharing and active knowledge seeking in IT, through seminars and discussion groups/ forums.