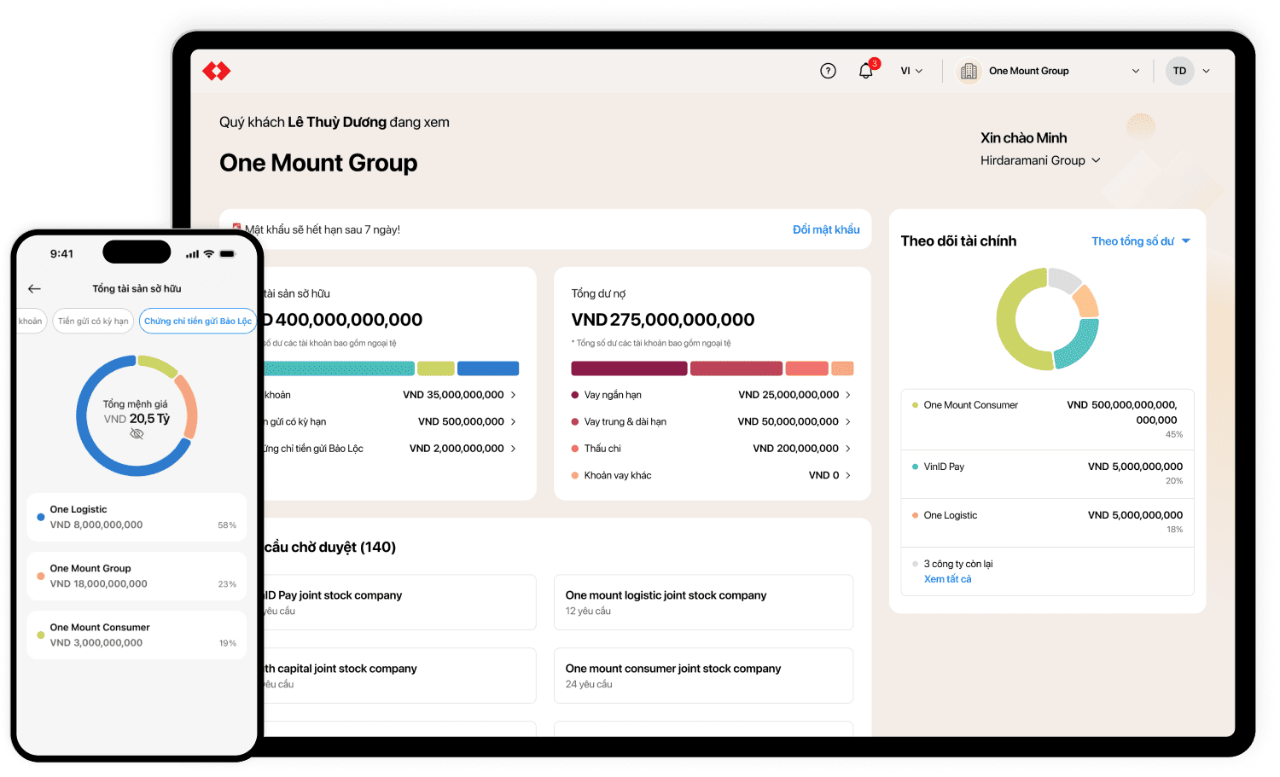

Centralized management

Gain full control of your group of companies with a single user account

- Access a real-time overview of financial positions across all entities

- Save time and operational costs

- Simplify processes and enhance cash flow efficiency

Gain full control of your group of companies with a single user account

Flexible for every business structure:

Operate with peace of mind:

Customize roles within the organization and set up approval layers by bank account, user, or transaction type/limit

Create a new user, assign access permissions, and customize online transaction limits.