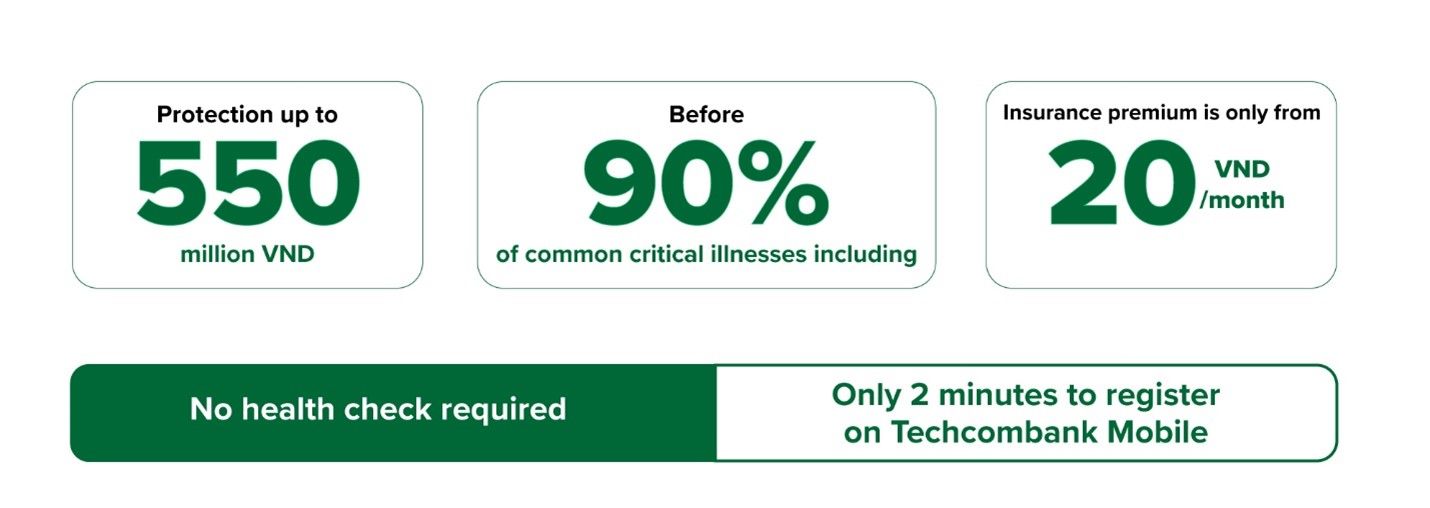

From May 2023 onwards, customers can subscribe to the insurance solution TechCare+ to ensure their financial well-being in the face of potential health risks with just a monthly minimum premium of VND 20,000.

[Hanoi, May 27, 2023] From May 2023 onwards, customers having transactions on Techcombank Mobile App are entitled to another available option in their plan for proactive healthcare. Customers can subscribe to the insurance solution TechCare+ to ensure their financial well-being in the

There is now an ongoing “trend”, especially among young people, in which people are actively taking care of their physical and mental health by running, hitting the gym and doing other activities. With that being said, “Green lifestyle”, “Self-love” and “Live-for-Yourself” are some of the movements that are enjoying unprecedented popularity. For instance, currently hundreds of unofficial running races in addition to 35 official ones are being organized in 2023, a threefold increase in the past few years.

This is clearly indicative of a society increasingly aware of proactive healthcare. Young and not-so-young members are constantly engaged in developing their breakthrough financial plans. These individuals are also rather proactive in protection solutions to future health risks given their self-love tendency and courage to live for themselves. According to the Insurance Association of Viet Nam, 11% of the population joined insurance policies from 2015 through 2019, in which health insurance witnessed the fastest growth. Notably, people under 40 choosing proactive healthcare solutions constituted a whopping 80%, much higher in comparison with those over 50.

The “Why not?” generation is generally tech-savvy and prefers integrated services that are time-saving and guard them off intermediary channels. The proactive healthcare solution TechCare+ integrated in Techcombank Mobile App just meets all these requirements of 4.0 customers.

TechCare+ protects the young with practical benefits

This solution for customers of the “Why not?” generation is made possible by the cooperation of Techcombank and its major insurance partner Manulife. It empowers customers to proactively manage their electronic insurance contracts integrated and synchronized in the Techcombank Mobile App, which ensures the easy access and transparency of information about contracts, compensation and benefits for customers. The product is characterized by three outstanding features, including a minimum monthly premium of only VND 20,000, health examination exemption and two minutes of online application. Customers may claim VND 200 million, 300 million and 500 million for fatal diseases with different package options, and VND 50 million for a death benefit coverage. The policy will be valid for one year.

Young people can easily apply for insurance 100% online

“The digital health insurance TechCare+ is an outstanding health insurance product served to our digitally-savvy "why not" customers, through Techcombank Mobile's modern technology platform, ushering in a new era of insurance and protection at finger tips, delivered with superior customer experience”., shared Mukesh Pilania, Head of Digital Banking, on the digital insurance product TechCare+.

|

How to apply for TechCare+ on Techcombank Mobile: |

|

If you need further information, please contact: