Hanoi, 20 Oct, 2022 - Vietnam Technological and Commercial Joint Stock Bank (“Techcombank” or the “Bank”) today announced another strong set of financial results for the nine months ended 30 September, 2022.

9M22 HIGHLIGHTS

Hanoi, 20 Oct, 2022 - Vietnam Technological and Commercial Joint Stock Bank (“Techcombank” or the “Bank”) today announced another strong set of financial results for the nine months ended 30 September, 2022.

“Our 9M PBT was up 22% YoY, on the back of strong performance across all key segments and accelerating GDP growth. In 3Q22, we saw some margin compression, but Techcombank retains a firm competitive advantage as an institution with a large CASA base and superior fee-generation capacity. The strength of our balance sheet was also confirmed by Moody’s upgrade of our baseline credit rating to ba2, the highest of any bank in Vietnam.

During 3Q22, we launched several unique new offerings designed to meet the banking needs of customers. We introduced αspire, our new comprehensive proposition for young and affluent customers. We also entered a partnership with Masan to create a “one-stop shop” for services that brings Techcombank’s financial offerings into Winmart stores. Our efforts to innovate ‘best in the-industry’ solutions were recognised externally when Techcombank was named “Best Consumer Digital Bank in Vietnam” by Global Finance, and through a host of other prestigious awards won during the quarter.”

- Jens Lottner, CEO Techcombank

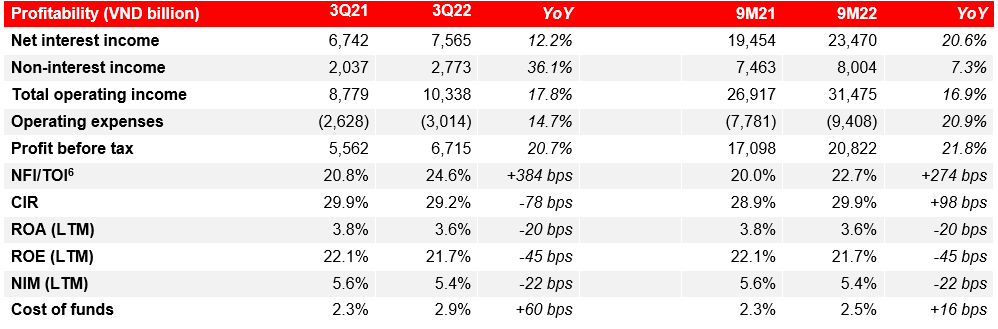

Income statements

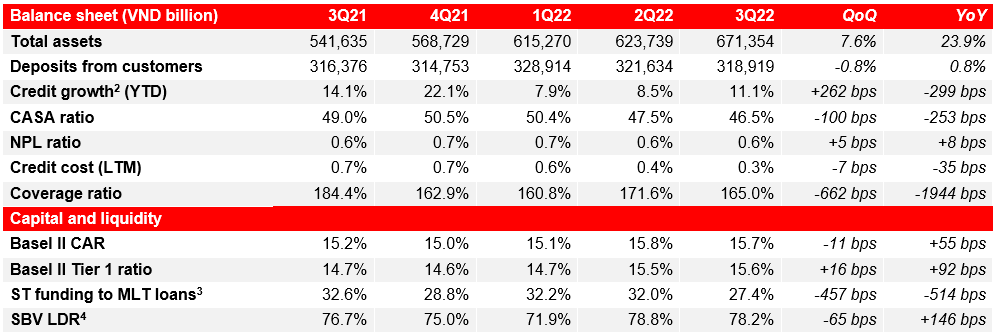

Balance sheet

Total assets grew 23.9% YoY to VND 671.4 trillion at 30 September 2022. The credit book continued to rotate from large corporates to retail customers, enhancing the risk profile and capital efficiency of the Bank:

Liquidity and capital

Asset quality

Subsidiaries

CUSTOMER AND OTHER HIGHLIGHTS

New customers & E-banking transactions

Techcombank ended 3Q22 with 10.4 million customers, adding over 300,000 in the last quarter. The number of retail customer transactions through e-banking channels grew to 205.4 million during 3Q, up 29.2% YoY, while total transaction value grew 30.6% YoY to VND 2.5 quadrillion.

Credit rating upgraded to Ba2 by Moody’s

On 7 September 2022, Moody’s Investor Service (“Moody’s”) upgraded Techcombank’s Baseline Credit Assessment (BCA) and credit rating. Specifically, Moody’s upgraded Techcombank’s long-term counterparty risk assessment (CRR) to Ba1 from Ba2 and long-term deposit to Ba2 from Ba3, with a ‘Stable’ outlook. Moody's also upgraded the Bank's BCA to ba2 from ba3. Techcombank is currently the only Vietnamese bank with a BCA of ba2.

According to Moody’s analysis, Techcombank now has the strongest creditworthiness among all Vietnamese banks, with capital and profitability Techcombank's key credit strengths.

Partnership with Masan to offer simple and intuitive “banking at your fingertips” services at Win stores

In September, Techcombank partnered with Masan to create the WINLife ecosystem, a one-stop-shop that provides customers with “All You Need”. This is the first ecosystem of its kind in Vietnam, bringing together two leading Vietnamese brands—Techcombank in banking and Masan in retail—to offer customers a host of essential financial and non-financial services on a single platform.

The WINLife ecosystem was launched at 27 WIN convenience stores situated in prime locations in Hanoi and Ho Chi Minh City, and will be extended to 80-100 WIN stores across the country between now and the end of the year. In the future, the WIN membership program has the potential to be scaled up to more than 3,000 WIN supermarkets and convenience stores nationwide, expanding Techcombank’s financial services to more customers across Vietnam.

Launching Techcombank 𝛂spire - the first financial brand dedicated to the young generation

In August 2022, Techcombank launched 𝛂spire, the first financial brand dedicated to the ‘Why not?’ generation of customers who are young, ambitious, and believe in a brighter future. Techcombank αspire offers personalized privileges and experiences tailored for younger customers to enable them to maximize value, optimize financial resources, and get a great banking experience.

For Techcombank 𝛂spire customers annual fees are waived for account management transactions at the counter, and there are no annual issuance fees for credit and debit cards. Customers receive unlimited cashback of up to 2% on spending, and a zero interest rate on installment purchases, among a suite of other benefits.

Awards and Recognition

In 3Q22, Techcombank was named “Best Consumer Digital Bank in Vietnam” by Global Finance in recognition of outstanding achievements in digital banking. To date, Techcombank is the first and the only bank in Vietnam to be honored with this prestigious award by Global Finance.

Techcombank won two awards at the 2022 Asian Banking & Finance (ABF) Retail Banking Awards, taking home the prizes for “Domestic Bank of the Year – Vietnam”, and “Credit Card Initiative of the Year – Vietnam".

For the third year in succession, the Asia Development Bank (ADB) named Techcombank “Vietnam Leading Partner Bank 2022”, based on the highest volume of transactions using ADB credit lines in the review period. This prize affirms the Bank’s outstanding achievements in expanding trade finance activities regionally and globally.

Learn more about Techcombank’s results:

Techcombank will present 3Q22 financial results via two conference calls

View the webcast and presentation slides any time at https://techcombank.com/en/investors/financial-information/documents (Tab “Documents”).

| Public relations contact: Nguyen Thi Bich Thuy PR – Marketing Division Tel: +84 24 3944 6368 – Ext: 8494 Email: thuyntb5@techcombank.com.vn |

Investor relations contact: Investor Relations Department Email: ir@techcombank.com.vn |

About Techcombank

Techcombank is listed on the HOSE as TCB VN. It was established in 1993 as Vietnam was transitioning from a centrally planned to a more market-oriented economy. Techcombank is now one of Vietnam’s largest joint stock banks and a leading Asian bank. The Bank pursues a proven customer centric strategy, with a broad range of banking solutions and services to more than 10.4 million customers, through an extensive network of 297 transaction offices. The Bank’s ecosystem approach, which is implemented across multiple key economic sectors, further differentiates Techcombank in one of the world’s fastest growing economies.

Techcombank is currently the only Vietnamese bank with a Baseline Credit Assessment (BCA) of ba2 (Stable Outlook), rated by Moody’s. S&P rates the Bank with BB- (Stable Outlook).

Techcombank awards include:

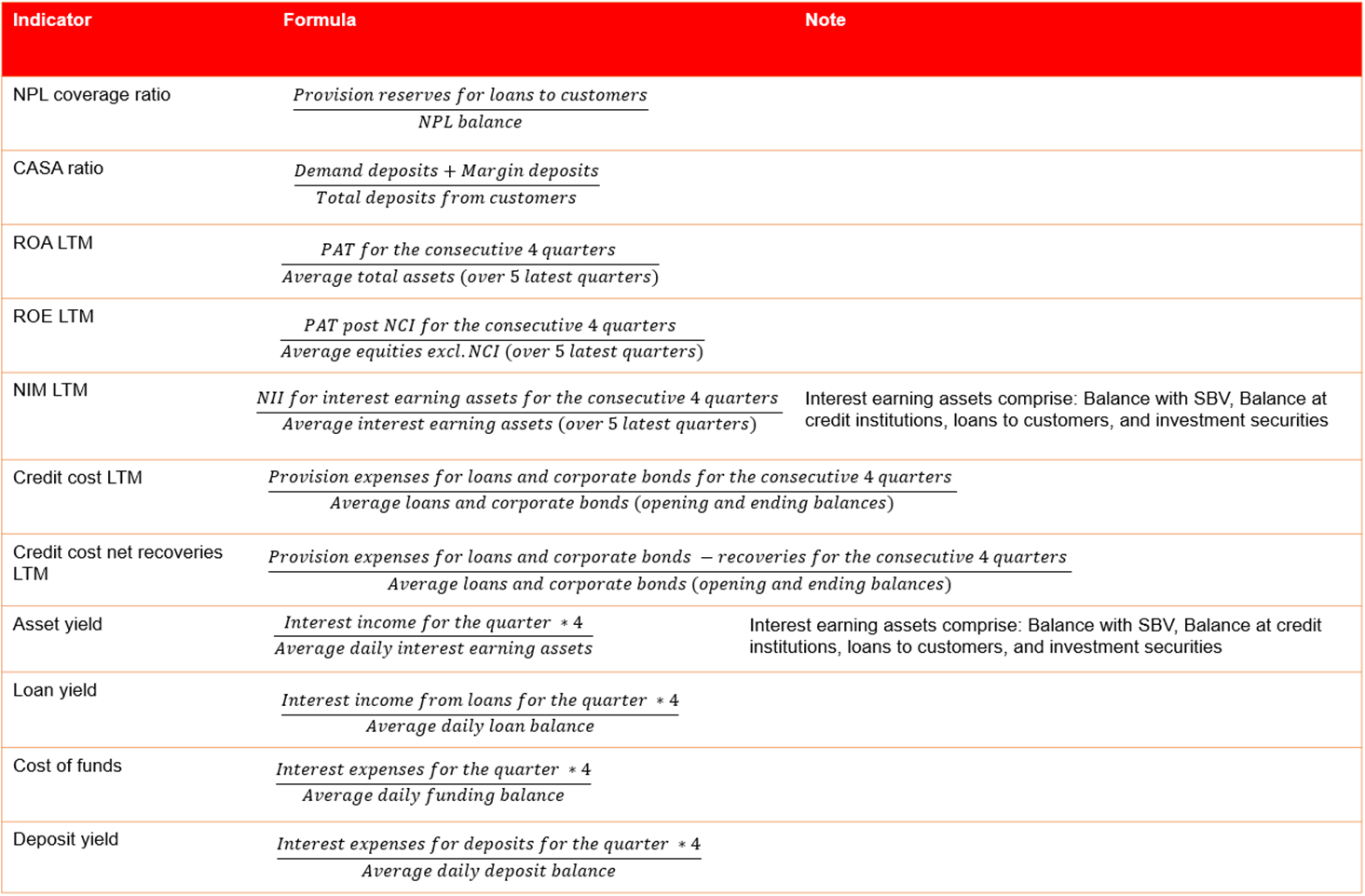

Acronyms:

APE – Annual premium equivalent

LC – Letter of Credit

CAR – Capital adequacy ratio

CASA – Current account savings account

CIR – Cost-to-income ratio

HOSE – Ho Chi Minh Stock Exchange

IB – Investment banking

LDR – Loan-to-deposit ratio

NII – Net interest income NFI – Net fee and commission income

NIM – Net interest margin (LTM)

NPL – Non-performing loan

PBT – Profit before tax

Q1, Q2, Q3, Q4 – Quarter 1,2,3,4

ROA – Return on assets

SME – Small and medium-sized enterprise

ST – Short-term

TCBS – Techcom Securities

TOI – Total operating income

VND – Vietnamese dong

YoY – Year-on-year

Notes:

1. NFI includes fee from bond distribution and FX sales

2. Credit growth under SBV regulations

3. Bank-only number; SBV limit: 37%

4. Bank-only number; SBV limit: 85%

5. n/a: not applicable

6. NFI includes fee from bond distribution and FX sales, TOI excludes recoveries